Corporate Governance

Governance Structure of the Commercial Bank is aimed at satisfying the legitimate claims of all stakeholders and to fulfil the Bank’s economic, social and environmental responsibilities in an exemplary and transparent manner.

Chairman’s Statement

Dear Stakeholder,

Let me begin by saying that your Bank was able to successfully meet the challenges in relation to all aspects of governance in 2013 as well.

As you are well aware, the Governance Structure of the Commercial Bank is aimed at satisfying the legitimate claims of all stakeholders and to fulfil the Bank’s economic, social and environmental responsibilities in an exemplary and transparent manner. Your Board ensures that the right strategies and controls are in place in order to deliver value to shareholders, customers, employees and the community in achieving the above goal.

Good Corporate Governance is part and parcel of our culture and business practices. As a well-governed Bank we place strong emphasis on corporate governance; striving to align business practices with the best interests of all our stakeholders, and also maximise transparency through timely information disclosure and financial reporting. The governance framework of the Bank provides for effective decision making.

As the Chairman of the Bank, I wish to assure all our stakeholders that your Board of Directors is fully committed to raise the bar to realise the Bank's strategy through ethical behaviour and promoting good governance practices across all units of the Bank.

This Section of the Annual Report demonstrates the Corporate Governance framework in place at Commercial Bank and how it ensures adherence to the requirements of the Banking Act Direction No. 11 of 2007 and amendments thereto, on ‘Corporate Governance for Licensed Commercial Banks in Sri Lanka’ issued by the Central Bank of Sri Lanka and the Code of Best Practice on Corporate Governance issued jointly by The Institute of Chartered Accountants of Sri Lanka (ICASL) and the Securities and Exchange Commission of Sri Lanka (SEC).

Whilst assuring you that we take every effort to continuously improve our Corporate Governance Philosophy, we hope that this brief message will be of value to you in assessing how the regulatory requirements and best practice are being put into action within your Bank. We welcome your valuable feedback to continue with our commitment to practice good governance at the highest levels at Commercial Bank.

Finally, I wish to confirm that to the best of my knowledge, I am not aware of any material violations of any of the provisions of the Codes and Directions referred to above.

Yours Sincerely,

D.S. Weerakkody

Chairman

Colombo

February 24, 2014.

Highlights in 2013

Re-elections to the Board at the Annual General Meeting held on March 28, 2013.

- Mr. K.G.D.D. Dheerasinghe, appointed as the Deputy Chairman of the Bank effective from December 31, 2011, was re-elected to the Board as the Deputy Chairman upon his re-election as a Director

Mr. Dheerasinghe is an Independent Non-Executive Director.

- Prof. U.P. Liyanage, a member of the Board since 2010 was re-elected to the Board as a Director.

Prof. Liyanage is an Independent Non-Executive Director since March 31, 2013.

- Mr. Jegatheesan Durairatnam, a member of the Board since April 2012 was re-elected to the Board as an Executive Director.

- Mr. S. Swarnajothi, a member of the Board since August 2012 was re-elected to the Board as a Director.

Exemplary Governance Model at Commercial Bank

“A company that is well governed is one that is accountable and transparent to its shareholders and other stakeholders, such as employees, creditors, customers and society at large“ ACCA

We at Commercial Bank believe in building an exemplary Corporate Governance Model which will enable the Bank to create value (through entrepreneurialism, innovation, development and exploration) and provide accountability and control systems, commensurate with the risks involved. Corporate Governance is a key element in improving organisational performance and sustainability as well as enhancing stakeholder confidence.

The diagram above portrays the key elements which support the Banks Governance Model together with the business strategy and direction through continuous engagement and communication with its owners, Board of Directors, Board Sub-Committees and Management which has strengthened the four governance pillars of the Bank.

Although mainstream governance principles have traditionally focused on legal and risk issues, finances, management structures, individual competencies, leadership and independence, we at the Bank also look into governance issues related to sustainability which operate beyond mere legal requirements and focus on process innovations that engage key knowledge-brokers through ‘softer’ forms of governance that take account of values and principles. Sustainability is gradually reshaping the way organisations approach Corporate Governance.

Steps Taken in 2013 to Uphold a Strong Governance Model at the Bank

- Re-election of a Non-Executive Deputy Chairperson, two Non-Executive Directors, Independent and Non-Independent in addition to the re-election of an Executive Director

- Refining the self-assessment process of the Directors

- Arrangements were made to ensure that all Non-Executive Directors were Independent by the end of 2013.

- A new Board Sub-Committee for Investment Governance was formed to strengthen the governance procedures in place at the Bank.

Statement of Compliance

The Bank is fully compliant with the requirements of the Banking Act Direction No. 11 of 2007 on ‘Corporate Governance for the Licensed Commercial Banks in Sri Lanka and subsequent amendments thereto issued by the Central Bank of Sri Lanka. The rules on ‘Corporate Governance Principles’ and the response of the Bank on its degree of compliance to the said rules are listed below.

Since the Bank is in compliance with the requirements of the aforesaid Direction of the Central Bank of Sri Lanka, the Colombo Stock Exchange exempted the Bank from complying with the requirements stipulated in Section 7.10 on ‘Corporate Governance’ of the Continuing Listing Requirements of the Colombo Stock Exchange issued in 2010.

In addition, your Bank adheres to the Code of Best Practice on Corporate Governance issued jointly by The Institute of Chartered Accountants of Sri Lanka (ICASL) and the Securities and Exchange Commission (SEC) of Sri Lanka.

Further, the Board of Directors to the best of their knowledge and belief and satisfied that all statutory payments due to the Government, other regulatory institutions and those payments related to employees, have been made on time.

Summary of Compliance

The table below depicts the requirements of the Direction No. 11 of 2007 and amendments thereto of the Central Bank of Sri Lanka and the Governance Code issued jointly by the ICASL and the SEC of Sri Lanka.

| Summary of Requirements as per the Direction of the Central Bank of Sri Lanka | Code Ref. |

| Responsibilities of the Board | 3 (1) |

| The Board’s Composition | 3 (2) |

| Criteria to Assess the Fitness and Propriety of Directors | 3 (3) |

| Management functions delegated by the Board | 3 (4) |

| Chairman and Chief Executive Officer | 3 (5) |

| Board Appointed Committees | 3 (6) |

| Related Party Transactions | 3 (7) |

| Disclosures | 3 (8) |

| Transitional and Other General Provisions | 3 (9) |

| Summary of Requirements as per the Joint Code of the ICASL and the SEC | Code Ref. |

| Chairman and Chief Executive Officer | A.2.1 |

| Board Balance | A.5.1 |

| Nomination Committee | A.7.1 |

| Appointment of New Directors | A.7.3 |

| Appraisal of Board Performance | A.9.3 |

| Board-related Disclosures | A.10.1 |

| Members of Remuneration Committee | B.1.3 |

| Disclosure of Remuneration | B.3 & B.3.1 |

| Communication with Shareholders | C.2.2 - C.2.7 |

| Major Transactions | C.3 & C.3.1 |

| Directors’ Report | D.1.2 |

| Financial Statements | D.1.3 |

| Statement on Internal Control | D.1.3 & D.2.3 |

| Management Report | D.1.4 |

| Going Concern | D.1.5 |

| Related Party Transactions | D.1.7 |

| Audit Committee Report | D.3.3 |

| Audit Committee | D.3.4 |

| Code of Business Conduct and Ethics | D.4.1 & D.4.2 |

| Corporate Governance Report | D.5.1 |

| Sustainability Reporting | G.1 - G.1.7 |

This is not an exhaustive list and is provided purely for the convenience of the readers of this Report in assessing the Bank’s level of adherence to the aforesaid Code and the Direction.

Major External Steering Instruments on Governance

- Companies Act No. 07 of 2007

- Banking Act No. 30 of 1988 and amendments thereto

- Banking Act Direction No. 11 of 2007 of the Central Bank of Sri Lanka on ‘Corporate Governance for Licensed Commercial Banks in Sri Lanka’ and amendments thereto

- Code of Best Practice on Corporate Governance issued jointly by The Institute of Chartered Accountants of Sri Lanka and the Securities and Exchange Commission of Sri Lanka (a voluntary Code)

- Listing Rules of the Colombo Stock Exchange

Major Internal Steering Instruments on Governance

- Articles of Association of the Bank

- Board of Directors’ working procedure

- Board approved policies on all major operational aspects

- Policy for secrecy of information, credit and other internal manuals

- Integrated risk management procedures

- Processes for anti-money laundering

- Processes for internal controls

- Bank’s Code of Ethics

- Bank’s whistle-blowers charter

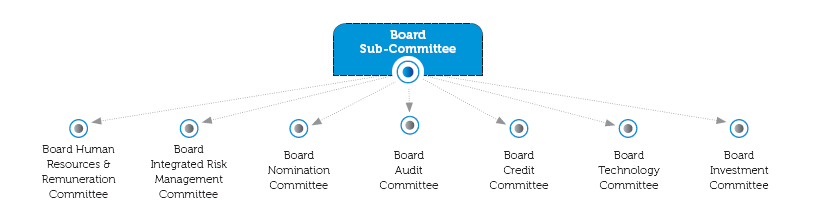

The Bank has in place a number of mandatory and voluntary Board Sub-Committees to fulfil regulatory requirements and for better governance of its activities. These committees meet regularly to consider and discuss matters falling within respective Charters and their recommendations are duly communicated to the main Board. These committees consist of Executive and Non-Executive Directors in varying proportions, as set out below.

Reference Web Links for Further Information

- Banking Act:

http://www.cbsl.gov.lk/pics_n_docs/09_lr/_docs/acts/BankingAct30_1988.pdf - Banking Act Direction

No. 11 of 2007:

http://www.cbsl.gov.lk/pics_n_docs/09_lr/_docs/directions/bsd/BSD_2011/bsd_directions_oct2011_LCB.pdf - Listing Rules of the Colombo Stock Exchange:

http://www.cse.lk/listing_rules.do - Companies Act:

http://www.drc.gov.lk/App/ComReg.nsf/200392d5acdb66c246256b76001be7d8/$FILE/Act%207%20of%202007%20(English).pdf

Composition of Main Board and Board Committees as at end 2013

| Gender | Age Group | |||||||

| Name of Committee | Executive Members | Non-Executive Members | Independent Members | Non-Independent Members | Male | Female | Below 30-50 Years | Over 50 Years |

| Main Board | 02 | 06 | 06 | 02 | 08 | Nil | Nil | 08 |

| Board Human Resources and Remuneration Committee | 01* | 03 | 03 | 01 | 04 | Nil | Nil | 04 |

| Board Integrated Risk Management Committee | 02 | 05 | 05 | 02 | 07 | Nil | Nil | 07 |

| Board Nomination Committee | 01* | 03 | 03 | 01 | 04 | Nil | Nil | 04 |

| Board Audit Committee | 02* | 04 | 04 | 02 | 06 | Nil | Nil | 06 |

| Board Credit Committee | 01* | 02 | 02 | 01 | 03 | Nil | Nil | 03 |

| Board Technology Committee | 02 | 01 | 01 | 02 | 03 | Nil | Nil | 03 |

| Board Investment Committee | 02 | 01 | 01 | 02 | 03 | Nil | Nil | 03 |

Information on composition, charter/mandate and methodologies of all Board Sub-Committees are given under the relevant committee reports.

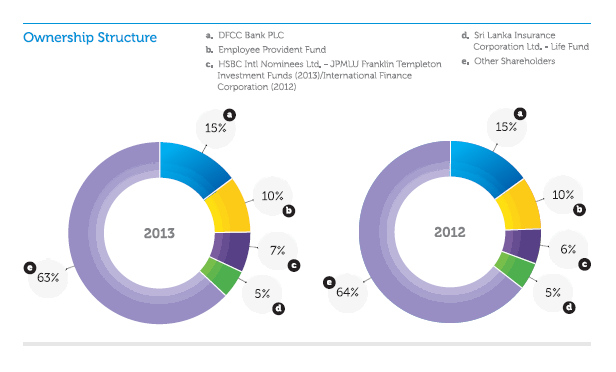

Ownership Structure

As per the share register at year-end 2013, the Bank had a total of 9,091 voting shareholders (9,509 voting shareholders as at end 2012) DFCC Bank PLC continued to be the largest shareholder, with a stake of 14.85% of the Ordinary Voting Shares of the Bank (14.87% in 2012). The top 20 voting shareholders of the Bank accounted for 68.83% of the total shareholding of the Bank (67.43% in 2012). These statistics amply demonstrates the strong confidence these shareholders have placed in the Bank. Details of the ownership structure is found on Item 4 of the Section on ‘Investor Relations Supplement’ including the names of the Twenty Largest Shareholders of the Bank as at end 2013.

All voting shareholders have the right to exercise their votes to impact decisions at the Annual General Meeting of the Bank and the Extraordinary General Meeting called upon as needed.

The information on ownership structure is published in the Interim Financial Statements of the Bank and it is also available on the Bank’s website, http://www.combank.net/newweb/interimfinancials

Annual General Meeting 2013

The Bank’s 44th Annual General Meeting (AGM) was held on March 28, 2013. At the AGM 345 (357 in 2012) voting shareholders and 130 (149 in 2012) non-voting shareholders were present by person or by proxy.

The following Resolutions were passed at the last AGM:

- Approval of Annual Report of the Board of Directors on the affairs of the Company and Statement of Compliance and the Financial Statements for the year ended December 31, 2012 and the Report of the Auditors thereon.

- Approval of a Final Dividend of Rs. 4.00 made for 2012 (Satisfied by way of Rs. 2/- in cash and Rs. 2/- in shares)

- Re-appointment /re-election of four Directors in place of those vacating, retiring by rotation or otherwise.

- Appointment of Messrs KPMG, Chartered Accountants, as the External Auditors of the Bank for 2013 and to authorise the Directors to approve their remuneration.

- Authorisation of the Board of Directors to determine donations for 2013.

A diagram detailing the Governance Structure of the Bank is illustrated under the Business Model and Strategic Imperatives for Value Creation section.

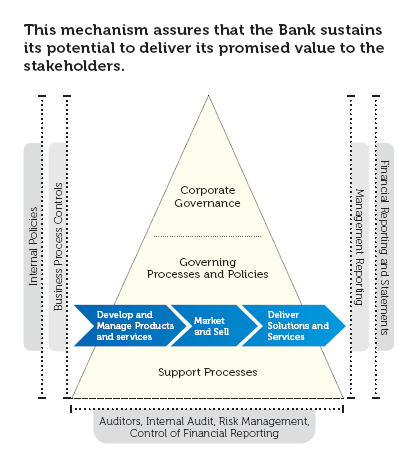

Operational Governance

“A Governance Operating Model is the mechanism used by the Board and Management to translate the elements of governance framework and policies into practices, procedures and job responsibilities within the Corporate Governance infrastructure”

Developing an effective Governance Operating model - by Deloitte Development LLC

The Board and Management of the Bank face the challenge of translating governance principles into practices. The Operating Governance model at the Bank acts as a vehicle for the Board and its committees to address these challenges by clearly defining the roles, responsibilities, accountabilities, information flows, and guidelines that the stakeholders require in order to implement a good governance framework.

Further, to fulfil the governance responsibilities, the Board should also have clear lines of sight into management’s decision-making and risk-management processes. In the governance operating model present at the Bank, the Board is able to establish clear lines of sight of the operational decisions made by the management and the risk exposures that may arise from same.

The Bank‘s Operating Governance model also addresses the complexity inherent in governance due to multiple business units/products available in the Bank and ensures effective co-ordination is prevalent at all times. It also ensures balancing considerations regarding centralisation versus decentralisation and considering local business, customer, compliance, legal, and other stakeholder needs.

The Governance model at the Bank clearly specifies the information that the Board and its Sub-Committees require and from whom, how often, and under what circumstances they will receive that information - this assists the Board in executing governance principles far more effectively.

The Board appointed Sub-Committees play a key role in assisting the Board in this regard.

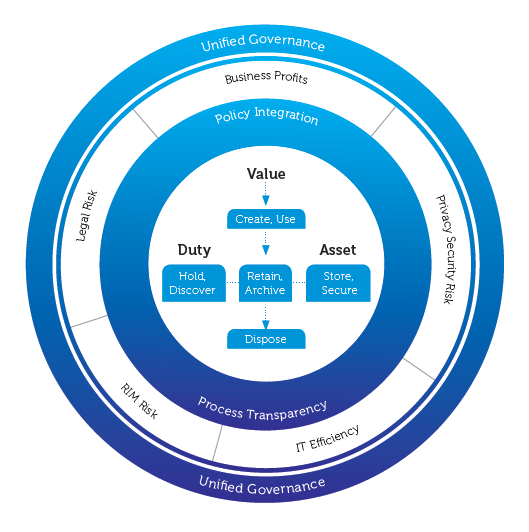

IT Governance

Information Technology has become the backbone for conducting banking business with almost exclusive reliance on the use of Information and Communication Technologies. Increasing complexities and criticalities in IT decision-making demands the Bank to adopt an effective IT Governance System.

As such, the right alignment of IT objectives with those of the Bank defined in the business terms is ensured by the Information Technology Governance Mechanism in place at the Bank. IT Governance which forms an integral part of the Bank’s Corporate Governance, deals primarily with optimising the linkage between Strategic Direction and Information Systems Management of the Bank. In this regard, having an organisational structure with well-defined roles for those responsible for information, business processes, applications, infrastructure, etc., ensure generation of value for our stakeholders while mitigating the risks associated with incorrect deployment and use of Information Technology.

The Board Technology Committee took several measures to further strengthen the IT Governance Mechanism at the Bank and this Committee is primarily responsible for ensuring implementation of the IT Governance Mechanism illustrated below:

The core objectives of the Bank’s Strategic Information Technology Governance which impact the diverse functional areas of the Bank are set out below:

| Objective | IT Governance Mechanism in place at Commercial Bank |

| Compliance |

|

| Operational Efficiency |

|

| Reliable Financial Reporting |

|

| Information Security Management |

|

| Prudent Capital Expenditure |

|

| Customer Convenience |

|

| IT Risk Management |

|

| ‘Green’ IT |

|

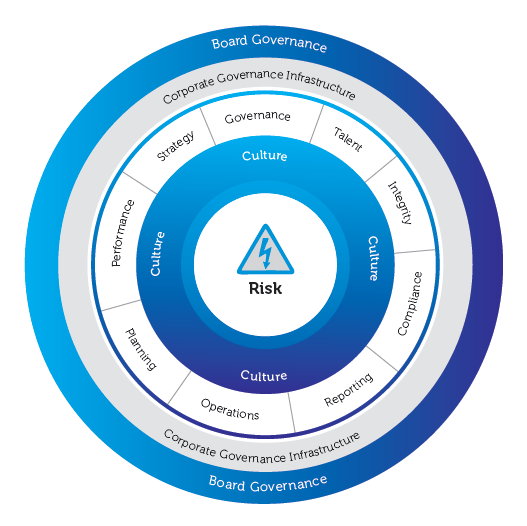

Integrated Risk Management at Commercial Bank

Integrity and the effectiveness of the Risk Management structure is well supported by the Bank’s Risk Governance and policy framework. This constitutes the foundation of the entire risk management function of the Bank. The primary responsibility of the Bank’s Integrated Risk Management Team headed by the Chief Risk Officer encompasses assuming calculated risks, accurately pricing them and prudently managing the risk portfolios, being the key components which continuously add value to the stakeholders in the business of banking.

Board of Directors strive to strike a balance in the risk and return to the stakeholders with the support of the Board Integrated Risk Management Committee formed in terms of the mandatory requirements of the Banking Act Direction No. 11 of 2007 on ‘Corporate Governance for Licensed Commercial Banks in Sri Lanka’ which establishes, co-ordinates and drives the risk management process throughout the Bank. The Integrated Risk Management System of the Bank steered by the aforesaid Board Sub-Committee with the assistance of the Integrated Risk Management Team ensures the timely identification and management of significant risks including exposure to Credit, Market and Operational Risks. Chief Risk Officer reports on the Risk Management Strategy regularly to the Board through the Board Integrated Risk Management Committee, the Report.

A full report on the Bank’s Risk Management Mechanism is found in the Section on ‘Managing Risk at Commercial Bank’.

Internal Controls Mechanism

The internal control framework of the Bank ensures management to deal with rapidly changing economic and competitive environments, shifting customer demands and priorities, and restructuring for future growth. Internal controls promote efficiency, reduce risk of asset loss, and help ensure the reliability of Financial Statements and compliance with laws and regulations. Further, the management has a better ability to provide the Board of Directors an overview of the management’s pursuit of achieving the operational and financial objectives whilst operating within the confines of the relevant legal requirements and reliable financial reporting.

The Internal Control process of the Bank, diagrammatically presented below depicts the process in place at the Bank which encompasses assessing the control environment on an on-going basis to ensure the existing control activities prevalent are evaluated regularly to mitigate probable risks and communicating same to the Board. Further, monitoring the effectiveness of the controls in place and assessing the probable risks of breach or lapses on an on-going basis is also an effective process in place at the Bank.

This process ensures effective communication within the Bank and contributes to ensuring that the right business decisions are made. The status of activities of the Bank’s control system is followed up continuously through periodic reporting to the Management and to the Board Audit Committee.

The Bank’s internal audit function is headed by the Deputy General Manager - Management Audit and is responsible for independent, objective assurance and oversight on internal control mechanism, in order to systematically evaluate and propose improvements for more effective internal control procedures, governance process, information system controls and risk management. Findings at internal audits are tabled at the meetings of the Board Audit Committee of the Bank in furtherance of the effectiveness of control mechanism.

As mandated by the Banking Act Direction No. 11 of 2007, the Board provides a report on the Bank’s internal control mechanism which confirms that the financial reporting system of the Bank has been designed to provide reasonable assurance regarding the reliability of financial reporting, and that the preparation of Financial Statements for external purposes is carried out in accordance with relevant accounting principles and regulatory requirements.

The Bank’s External Auditors’ Reports also provide the Board with the evidence that enables it to conclude whether the Bank’s Internal Control Mechanism is appropriately designed and is operating effectively.

The Report of the Board Audit Committee sets out its terms of reference, objectives and function.

Our Code of Ethics

Your Bank pays close attention to the moral concerns in order to make the right ethical decisions on a day-to-day basis over and above observing the law. We at Commercial Bank believe that the upholding of an ethical culture in banking is of critical interest to the customers, employees, regulators, alike and to the Bank itself as a secured, reliable and efficient banking system is one of the pillars of economic stability of any country. Hence, nurturing an ethical culture is of utmost importance

for banks.

Our core ethical values include honesty, integrity, fairness, responsible citizenship and accountability.

Enforcing a Corporate Code of Ethics requires understanding and active participation by everyone in the Bank since the Code spells out the expected standards of behaviour and sets the operating principles to be followed. Every official at the Bank is required to ensure that at all times they maintain highest ethical standards and that adequate internal control measures are in place guarding against unethical practices and irregularities.

To make the Code effective, the Bank endeavours:

- To apply core values and principles embodied consistently

- For management to display the fullest support to the Code and serve as role models for compliance

- To ensure that all personnel strictly comply with the Code

- To fair rewarding and punishment be effected under a transparent system

- To communicate the contents to all employees and even make the Code available to those outside the Bank

- To review and revise regularly

In addition, our six steps ‘ETHICS PLUS Decision-Making Model’ encompasses:

- Establishing the relevant facts and identifying the ethical issues

- Taking stock of all stakeholders or parties involved

- Having an objective assessment of each stakeholder’s position

- Identifying viable alternatives and their effects on stakeholders

- Comparing and evaluating the likely consequences of each alternative with reference to the standards expected

- Selecting the most appropriate course of action

In a nutshell, our business ethics means, “Choosing the good over the bad, the right over the wrong, the fair over the unfair and the truth over the untruth”. Also amongst the guiding principles of the Bank’s Code of Ethics are strict compliance, confidentiality, avoidance of conflicts of interest, encouraging the reporting by the Officers of the Bank on illegal and unethical behaviour.

Please refer the web link for additional information on the Bank’s Code of Ethics: http://www.combank.net/newweb/info/104?oid=57

Bank’s Compliance with Direction No. 11 of 2007, issued by the Central Bank of Sri Lanka on the subject ‘Corporate Governance for Licensed Commercial Banks in Sri Lanka’

Annual Corporate Governance Report of Commercial Bank of Ceylon PLC (‘the Bank’) for the year ended December 31, 2013 is given below:

In terms of Section 46 (1) of the Banking Act No. 30 of 1988, subsequently amended, the Monetary Board has been empowered to issue Directions to Licensed Commercial Banks, regarding the manner in which the business of such banks is to be conducted, in order to ensure the soundness of the banking system. In the exercise of the powers conferred by the above section, the Monetary Board has issued Banking Act Direction No. 11 of 2007 on ‘Corporate Governance for Licensed Commercial Banks in Sri Lanka’.

The aforesaid Direction consists of two distinct parts viz., Direction 2 and Direction 3. Direction 2 consists of eight principles, for explanatory purposes and/or clarification purposes only. Strict compliance is necessary for the rules that are set out in Direction 3. The Bank made every endeavour to comply with the Rules of Corporate Governance as indicated in Direction 3 of the Corporate Governance Direction. Details of such compliance for the year 2013 are fully disclosed below against each requirement of Direction 3.

| Relevant Section | Rule | Degree of Compliance | |||||||||||||||

| 3 (1) - Responsibilities of the Board | |||||||||||||||||

| 3 (1) (i) | The Board shall strengthen the safety and soundness of the Bank by ensuring the implementation of the following: | ||||||||||||||||

| (a) Approve and oversee the Bank’s strategic objectives and corporate values and ensure that these are communicated throughout the Bank; | Complied with. Approving, overseeing, and monitoring the execution of the strategic objectives, corporate values, overall business strategy and policies are handled directly by the Board. Board’s views relating to the above are communicated throughout the Bank. |

||||||||||||||||

| (b) Approve the overall business strategy of the Bank, including the overall risk policy and risk management procedures and mechanisms with measurable goals, for at least the next three years; | Complied with. Bank’s Strategic Plan for the 5 year period of 2013-2017 was approved by the Board on January 16, 2013 after discussing related issues in detail with the Corporate Management. Risk Management Policies and Risk Management procedures and mechanisms with measurable goals are included in the said review. Bank’s Strategic Plan for 2014-2018 was approved on February 17, 2014 by the Board. |

||||||||||||||||

| (c) Identify the principal risks and ensure implementation of appropriate systems to manage the risks prudently; | Complied with. Identifying principal risks, approving overall risk policy and Risk Management procedures are carried out mainly through the Board Integrated Risk Management Committee which is reviewed annually. |

||||||||||||||||

| (d) Approve implementation of a policy of communication with all stakeholders, including depositors, creditors, shareholders and borrowers; | Complied with. A Board approved Communication Policy is available and reviewed, as and when required. Annual General Meeting is also used to have an effective dialogue with the shareholders on matters which are relevant and of concern to the general membership. |

||||||||||||||||

| (e) Review the adequacy and the integrity of the Bank’s Internal Control Systems and Management Information Systems; | Complied with. Adequacy and the integrity of the Bank’s Internal Control Systems over financial reporting and Management Information Systems are reviewed by the Board Audit Committee. Board Audit Committee reports are submitted to the Board periodically for review. |

||||||||||||||||

| (f) Identify and designate Key Management Personnel, as defined in the International Accounting Standards, who are in a position to: (i) significantly influence policy; (ii) direct activities; and (iii) exercise control over business activities, operations and risk management; | Complied with. Board of Directors and Members of the Corporate Management who fall into the defined criteria are designated as Key Management Personnel. The definition of the KMP is reviewed as and when necessary. |

||||||||||||||||

| (g) Define the areas of authority and key responsibilities for the Board Directors themselves and for the Key Management Personnel; | Complied with. Bank has a Board approved Formal Schedule which is the Board Charter for matters specifically reserved for Board, defining the areas of authority and key responsibilities of the Board Directors. Areas of authority and key responsibilities for members of the Corporate Management are stated in the Job Descriptions of each member. |

||||||||||||||||

| (h) Ensure that there is appropriate oversight of the affairs of the Bank by Key Management Personnel, that is consistent with Board policy; | Complied with. Affairs of the Bank are regularly discussed and monitored by the Directors at the Board level and by the Members of Corporate Management at Management Level. |

||||||||||||||||

| (i) Periodically assess the effectiveness of the Board Directors’ own governance practices, including: (i) the selection, nomination and election of Directors and Key Management Personnel; (ii) the management of conflicts of interests; and (iii) the determination of weaknesses and implementation of changes where necessary; | Complied with. An Evaluation Form specifically designed to cover the related areas was completed by the Directors for the purpose of evaluating the effectiveness for 2013. Responses of Directors were discussed for necessary action at a Nomination Committee meeting and a subsequent Board Meeting. Directors make declarations on areas of interests at the time of applying to the Bank Board and subsequently as and when it is needed. Conflict of interest (if any) is managed based on this information. A quarterly report is sent to the Board on possible areas of conflict (if any). |

||||||||||||||||

| (j) Ensure that the Bank has an appropriate succession plan for Key Management Personnel; | Complied with. Succession Plan is reviewed at regular intervals to ensure that the Bank has named successors for the key management positions in the Bank and has development plans to ensure their readiness. |

||||||||||||||||

| (k) Meet regularly, on a need basis, with the Key Management Personnel to review policies, establish communication lines and monitor progress towards corporate objectives; | Complied with. The Members of the Corporate Management regularly make presentations and take part in discussions on their areas of responsibility and to monitor progress made towards achieving corporate objectives at Board meetings. |

||||||||||||||||

| (l) Understand the regulatory environment and ensure that the Bank maintains an effective relationship with regulators; | Complied with. | ||||||||||||||||

| (m) Exercise due diligence in the hiring and oversight of External Auditors. | Complied with. The Board has adopted a Policy of Rotation of Auditors, once in every 5 years, in keeping with the principles of Good Corporate Governance. At the end of the 5-year period, quotations are called from suitable Audit Firms, prior to the recommendation of new Auditors as per the Rotation Policy. In addition to this, External Auditors submit a statement annually confirming their independence as required by Section 163 (3) of the Companies Act No. 07 of 2007 in connection with external audit. |

||||||||||||||||

| 3 (1) (ii) | The Board shall appoint the Chairman and the Chief Executive Officer and define and approve the functions and responsibilities of the Chairman and the Chief Executive Officer in line with Direction 3 (5) of these Directions. | Complied with.

Positions of the Chairman and the Managing Director (MD)/Chief Executive Officer (CEO) are separated. Further, functions and responsibilities of the Chairman and the CEO are properly defined and approved in line with Direction 3 (5) of these Directions.

|

|||||||||||||||

| 3 (1) (iii) | The Board shall meet regularly and Board meetings shall be held at least twelve times a year at approximately monthly intervals. Such regular Board meetings shall normally involve active participation in person of a majority of Directors entitled to be present. Obtaining the Board’s consent through the circulation of written resolutions/papers shall be avoided as far as possible. | Complied with.

Board Meetings are held monthly, mainly to review the performance of the Bank and its Subsidiaries and other relevant matters referred to the Board by the Heads of respective divisions, while special Board Meetings are convened whenever necessary. During 2013, the Board met 12 times. These meetings ensure that prompt action is taken to align the business processes to achieve the expectations of all stakeholders. See ‘Number of Meetings Held and Attendance’detailed at the end of this section. |

|||||||||||||||

| 3 (1) (iv) | The Board shall ensure that arrangements are in place to enable all Directors to include matters and proposals in the agenda for regular Board Meetings where such matters and proposals relate to the promotion of business and the management of risks of the Bank. | Complied with.

All Board members are given an equal opportunity to include matters and proposals in the Agenda, where such proposals relate to the promotion of business and the management of risks of the Bank. |

|||||||||||||||

| 3 (1) (v) | The Board procedures shall ensure that notice of at least 7 days is given of a regular Board Meeting to provide all Directors an opportunity to attend. For all other Board meetings, reasonable notice may be given. | Complied with.

Monthly Board meetings are generally scheduled for the last Friday of the month and Notices are sent 1 week before the date of the meeting. For any other Special Board meeting, adequate Notice is given. |

|||||||||||||||

| 3 (1) (vi) | The Board procedures shall ensure that a Director who has not attended at least two-thirds of the meetings in the period of

12 months immediately preceding or has not attended the immediately preceding three consecutive meetings held, shall cease to be a Director. Participation at the Directors’ meetings through an alternate Director shall, however, be acceptable as attendance. |

Complied with.

All Directors attended every meetings (12) held during 2013. |

|||||||||||||||

| 3 (1) (vii) | The Board shall appoint a Company Secretary who satisfies the provisions of Section 43 of the Banking Act No. 30 of 1988, whose primary responsibilities shall be to handle the secretariat services to the Board and shareholder meetings and to carry out other functions specified in the statutes and other regulations. | Complied with.

An Attorney-at-Law/Chartered Secretary with over 15 years experience functions as the Secretary of the Board and she has taken steps to duly comply with the requirements under the Banking Act No. 30 of 1988. She has also ensured that proper Board procedures are followed and that applicable rules and regulations are adhered to. |

|||||||||||||||

| 3 (1) (viii) | All Directors shall have access to advice and services of the Company Secretary with a view to ensuring that Board procedures and all applicable rules and regulations are followed. | Complied with.

All Board members have full access, to the assistance of the Company Secretary to ensure that proper Board procedures are followed and all applicable rules and regulations are complied with. |

|||||||||||||||

| 3 (1) (ix) | The Company Secretary shall maintain the minutes of Board meetings and such minutes shall be open for inspection at any reasonable time, on reasonable notice by any Director. | Complied with.

The Company Secretary maintains the minutes of Board meetings with sufficient details and the minutes are open for inspection by any Director. |

|||||||||||||||

| 3 (1) (x) | Minutes of Board meetings shall be recorded in sufficient detail so that it is possible to gather from the minutes, as to whether the Board acted with due care and prudence in performing its duties. The minutes shall also serve as a reference for regulatory and supervisory authorities to assess the depth of deliberations at the Board meetings. Therefore, the minutes of a Board meeting shall clearly contain or refer to the following: (a) a summary of data and information used by the Board in its deliberations; (b) the matters considered by the Board; (c) the fact-finding discussions and the issues of contention or dissent which may illustrate whether the Board was carrying out its duties with due care and prudence; (d) the testimonies and confirmations of relevant executives which indicate compliance with the Board’s strategies and policies and adherence to relevant laws and regulations; (e) the Board’s knowledge and understanding of the risks to which the Bank is exposed and an overview of the risk management measures adopted; and (f) the decisions and Board resolutions. | Complied with.

The Company Secretary records the minutes of Board meetings with sufficient details to satisfy all the requirements of this direction. Draft minutes prepared by the Company Secretary are approved by the Chief Executive Officer and Chairman and then circulated among other Directors for their observations. Necessary amendments are made thereto based on the issues raised by such other Directors. |

|||||||||||||||

| 3 (1) (xi) | There shall be a procedure agreed by the Board to enable Directors, upon reasonable request, to seek independent professional advice in appropriate circumstances, at the Bank’s expense. The Board shall resolve to provide separate independent professional advice to Directors to assist the relevant Director or Directors to discharge his/her/their duties to the Bank. | Complied with.

The Directors are permitted to seek independent professional advice at the Bank’s expense. A Board approved procedure is in place in this connection. |

|||||||||||||||

| 3 (1) (xii) | Directors shall avoid conflicts of interests, or the appearance of conflicts of interest, in their activities with, and commitments to, other organisations or related parties. If a Director has a conflict of interest in a matter to be considered by the Board, which the Board has determined to be material, the matter should be dealt with at a Board meeting, where Independent Non-Executive Directors [Refer to Direction 3 (2) (iv) of these Directions] who have no material interest in the transaction, are present. Further, a Director shall abstain from voting on any Board resolution in relation to which he/she or any of his/her close relation or a concern, in which a Director has substantial interest, is interested and he/she shall not be counted in the quorum for the relevant agenda item at the Board meeting. |

Complied with.

Directors do not participate in making decisions on matters, in which they have an interest and avoid conflicts of interest with the activities of the Bank. Such Directors’ presence is disregarded in counting the quorum for agenda of meetings at which such issues are considered. Directors make declarations on areas of interests at the time of applying to the Bank Board and subsequently as and when it is needed. Conflict of interest (if any) is managed based on this information. A quarterly report is sent to the Board on possible areas of conflict (if any). |

|||||||||||||||

| 3 (1) (xiii) | The Board shall have a formal schedule of matters specifically reserved to it for decision to ensure that the direction and control of the Bank is firmly under its authority. | Complied with.

The Board has put in place systems and controls to facilitate the effective discharge of Board functions. Pre-set agenda of meetings ensures the direction and control of the Bank is firmly under Board’s control and authority. |

|||||||||||||||

| 3 (1) (xiv) | The Board shall, if it considers that the Bank is, or is likely to be, unable to meet its obligations or is about to become insolvent or is about to suspend payments due to depositors and other creditors, forthwith inform the Director of Bank Supervision of the situation of the Bank prior to taking any decision or action. | No such situations have arisen. The Bank has a Board approved procedure to take action in the event of such a possibility. |

|||||||||||||||

| 3 (1) (xv) | The Board shall ensure that the Bank is capitalised at levels as required by the Monetary Board in terms of the Capital Adequacy ratio and other prudential grounds. | Complied with.

The Bank has duly complied with Capital Adequacy requirements and requirements under other prudential grounds throughout the year. |

|||||||||||||||

| 3 (1) (xvi) | The Board shall publish in the Bank’s Annual Report, an Annual Corporate Governance Report setting out the compliance with Direction 3 of these Directions. | Complied with.

This Report serves the said requirement. |

|||||||||||||||

| 3 (1) (xvii) | The Board shall adopt a scheme of self-assessment to be undertaken by each Director annually and maintain records of such assessments. | Complied with.

The Bank has adopted a system of self-assessment, to be undertaken by each Director, annually. |

|||||||||||||||

3 (2) - The Board’s Composition |

|||||||||||||||||

| 3 (2) (i) | The number of Directors on the Board shall not be less than 7 and not more than 13. | Complied with. Currently, there are 8 Directors on the Board. |

|||||||||||||||

| 3 (2) (ii) | (a) The total period of service of a Director other than a Director who holds the position of Chief Executive Officer, shall not exceed nine years and such period in office shall be inclusive of the total period of service served by such Director up to January 1, 2008.

(b) In this context, the following transitional provisions shall apply: A Director who has completed 9 years as at January 1, 2008, or who completes such term at any time prior to December 31, 2008, may continue for a further maximum period of 3 years commencing January 1, 2009. |

Complied with. The period of service of all the Non-Executive Directors are within 9 years. |

|||||||||||||||

| 3 (2) (iii) | An employee of a bank may be appointed, elected or nominated as a Director of the Bank (hereinafter referred to as an ‘Executive Director’) provided that the number of Executive Directors shall not exceed one-third of the number of Directors of the Board. In such an event, one of the Executive Directors shall be the Chief Executive Officer of the Bank. | Complied with.

There are two Executive Directors namely Managing Director and the Chief Operating Officer on the Board. Accordingly, the number of Executive Directors does not exceed one-third of the total number of Directors of the Board. |

|||||||||||||||

| 3 (2) (iv) | The Board shall have at least three Independent Non-Executive Directors or one-third of the total number of Directors, whichever is higher. This sub-direction shall be applicable from January 1, 2010 onwards.

A Non-Executive Director shall not be considered independent if he/she:

(a) has direct and indirect shareholdings of more than 1% of the Bank; |

Complied with. |

|||||||||||||||

| (b) currently has or had during the period of two years immediately preceding his/her appointment as Director, any business transactions with the Bank as described in Direction 3 (7) hereof, exceeding 10% of the regulatory capital of the Bank; | |||||||||||||||||

| (c) has been employed by the Bank during the two-year period immediately preceding the appointment as Director; | |||||||||||||||||

| (d) has a close relation who is a Director or Chief Executive Officer or a member of Key Management Personnel or a material shareholder of the Bank or another Bank. For this purpose, a ‘close relation’ shall mean the spouse or a financially dependent child; | |||||||||||||||||

| (e) represents a specific stakeholder of the Bank; | |||||||||||||||||

(f) is an employee or a Director or a material shareholder in a company or business organisation:

|

|||||||||||||||||

| 3 (2) (v) | In the event an alternate Director is appointed to represent an Independent Director, the person so appointed shall also meet the criteria that apply to the Independent Director. | No such situation has arisen. | |||||||||||||||

| 3 (2) (vi) | Non-Executive Directors shall be persons with credible track records and/or have necessary skills and experience to bring an independent judgment to bear on issues of strategy, performance and resources. | Complied with.

The profiles of all Directors including Non-Executive Directors details their skills and experience. |

|||||||||||||||

| 3 (2) (vii) | A meeting of the Board shall not be duly constituted, although the number of Directors required to constitute the quorum at such meeting is present, unless more than one-half of the number of Directors present at such meeting are Non-Executive Directors. This sub-direction shall be applicable from January 1, 2010 onwards. | Complied with.

All Board meetings held during 2013 were duly constituted with the presence of all the Non-Executive Directors. See ‘Number of Meetings Held and Attendance’detailed at the end of this section. |

|||||||||||||||

| 3 (2) (viii) | The Independent Non-Executive Directors shall be expressly identified as such in all corporate communications that disclose the names of Directors of the Bank. The Bank shall disclose the composition of the Board, by category of Directors, including the names of the Chairman, Executive Directors, Non-Executive Directors and Independent Non-Executive Directors in the Annual Corporate Governance Report. | Complied with.

See Note 1 at the end of this section. |

|||||||||||||||

| 3 (2) (ix) | There shall be a formal, considered and transparent procedure for the appointment of new Directors to the Board. There shall also be procedures in place for the orderly succession of appointments to the Board. | Complied with.

New appointments to the Board and re-elections of Directors are based on the recommendations of the Board Nomination Committee. There is a procedure in place for the orderly succession of appointments to the Board. See the ‘Board Nomination Committee Report’. |

|||||||||||||||

| 3 (2) (x) | All Directors appointed to fill a casual vacancy shall be subject to election by shareholders at the first general meeting after their appointment. | Complied with.

All Directors appointed to the Board are subject to re-election by shareholders at the first Annual General Meeting after their appointment. |

|||||||||||||||

| 3 (2) (xi) | If a Director resigns or is removed from office, the Board shall: (a) announce the Director’s resignation or removal and the reasons for such removal or resignation including but not limited to information relating to the relevant Director’s disagreement with the Bank, if any; and (b) issue a statement confirming whether or not there are any matters that need to be brought to the attention of shareholders. |

No removal or resignation of Directors took place during the year. However, there is a procedure in place to deal with such situations. | |||||||||||||||

| 3 (2) (xii) | A Director or an employee of a Bank shall not be appointed, elected or nominated as a Director of another Bank except where such Bank is a Subsidiary Company or an Associate Company of the first mentioned Bank. | Complied with.

None of the present Directors of the Bank acts as a Director of another Bank. See the Profiles of Directors. |

|||||||||||||||

3 (3) - Criteria to Assess the Fitness and Propriety of Directors |

|||||||||||||||||

| In addition to provisions of Section 42 of the Banking Act No. 30 of 1988, the criteria set out below shall apply to determine the fitness and propriety of a person who serves or wishes to serve as a Director of a Bank. Non-compliance with any one of the criteria as set out herein shall disqualify a person to be appointed, elected or nominated as a Director or to continue as a Director. | Complied with. Declarations are submitted by each Director declaring their suitability (fit and proper test) annually. These affidavits and declarations are considered and discussed initially at a Nomination Committee meeting and thereafter at a Board meeting by the Board for necessary action. |

||||||||||||||||

| 3 (3) (i) | The age of a person who serves as Director shall not exceed 70 years. (A) In this connection, the following general exemption shall apply:

A Director who has reached the age of 70 years as at January 1, 2008 or who would reach the age of 70 years prior to December 31, 2008 may continue in office for a further maximum period of 3 years commencing January 1, 2009. |

Complied with. All Directors are below 70 years of age. |

|||||||||||||||

| 3 (3) (ii) | A person shall not hold office as a Director of more than 20 companies/entities/institutions inclusive of Subsidiaries or Associate Companies of the Bank. | Complied with. No Director holds directorships of more than 20 companies/entities/institutions inclusive of Subsidiaries or Associate Companies of the Bank. |

|||||||||||||||

3 (4) - Management Functions Delegated by the Board |

|||||||||||||||||

| 3 (4) (i) | The Directors shall carefully study and clearly understand the delegation arrangements in place. | Complied with. | |||||||||||||||

| 3 (4) (ii) | The Board shall not delegate any matters to a Board Committee, Chief Executive Officer, Executive Directors or Key Management Personnel, to an extent that such delegation would significantly hinder or reduce the ability of the Board as a whole to discharge its functions. | The Board is empowered by the Articles of Association to delegate to the MD/CEO any of the powers vested with the Board, upon such terms and conditions and with such restrictions as the Board may think fit. | |||||||||||||||

| 3 (4) (iii) | The Board shall review the delegation processes in place on a periodic basis to ensure that they remain relevant to the needs of the Bank. | Complied with.

A delegation process is in place and the delegated powers are reviewed periodically to ensure that they remain relevant to the needs of the Bank. |

|||||||||||||||

3 (5) - The Chairman and Chief Executive Officer |

|||||||||||||||||

| 3 (5) (i) | The roles of Chairman and Chief Executive Officer shall be separate and shall not be performed by the same individual. | Complied with.

There is a clear separation of duties between the roles of the Chairman and the CEO, thereby preventing unfettered powers for decision making being vested with one person. |

|||||||||||||||

| 3 (5) (ii) | The Chairman shall be a Non-Executive Director and preferably an Independent Director as well. In the case where the Chairman is not an Independent Director, the Board shall designate an Independent Director as the Senior Director, with suitably documented terms of reference to ensure a greater independent element. The designation of the Senior Director shall be disclosed in the Bank’s Annual Report. | Complied with.

Chairman is an Independent Non-Executive Director. |

|||||||||||||||

| 3 (5) (iii) | The Board shall disclose in its Corporate Governance Report, which shall be an integral part of its Annual Report, the identity of the Chairman and the Chief Executive Officer and the nature of any relationship [including financial, business, family or other material/relevant relationship(s)], if any, between the Chairman and the Chief Executive Officer and the relationships among members of the Board. | Complied with.

The Board is aware that there are no relationships whatsoever, including financial, business, family, any other material/relevant relationship between the Chairman and the CEO. Similarly, no relationships prevail among the other members of the Board, other than the following: - Prof. U.P. Liyanage and Mr. M.P. Jayawardena were Directors of another company until March 30, 2013. - Messrs M.P. Jayawardena and W.M.R.S. Dias were Directors of another company until October 30, 2013. See Note 2 for further details at the end of this section. |

|||||||||||||||

| 3 (5) (iv) | The Chairman shall:

(a) provide leadership to the Board; (b) ensure that the Board works effectively and discharges its responsibilities; and (c) ensure that all key and appropriate issues are discussed by the Board in a timely manner. |

Complied with.

Board approved List of Functions and Responsibilities of Chairman include, ‘Providing Leadership to the Board’ as a responsibility of the Chairman. The Board’s annual Assessment Form includes an area to measure the ‘Effectiveness of the Chairman in facilitating the effective discharge of Board functions’. All key and appropriate issues are discussed by the Board on a timely basis. |

|||||||||||||||

| 3 (5) (v) | The Chairman shall be primarily responsible for drawing up and approving the agenda for each Board meeting, taking into account where appropriate, any matters proposed by the other Directors for inclusion in the agenda. The Chairman may delegate the drawing up of the agenda to the Company Secretary. | Complied with. | |||||||||||||||

| 3 (5) (vi) | The Chairman shall ensure that all Directors are properly briefed on issues arising at Board meetings and also ensure that Directors receive adequate information in a timely manner. | Complied with. | |||||||||||||||

| 3 (5) (vii) | The Chairman shall encourage all Directors to make a full and active contribution to the Board’s affairs and take the lead to ensure that the Board acts in the best interests of the Bank. | Complied with. | |||||||||||||||

| 3 (5) (viii) | The Chairman shall facilitate the effective contribution of Non-Executive Directors in particular and ensure constructive relations between Executive and Non-Executive Directors. |

Complied with. | |||||||||||||||

| 3 (5) (ix) | The Chairman, shall not engage in activities involving direct supervision of Key Management Personnel or any other executive duties whatsoever. | Complied with.

The Chairman does not directly get involved in the supervision of Key Management Personnel or any other executive duties. |

|||||||||||||||

| 3 (5) (x) | The Chairman shall ensure that appropriate steps are taken to maintain effective communication with shareholders and that the views of shareholders are communicated to the Board. | Complied with.

At the Annual General Meeting the shareholders are given the opportunity to take up matters for which clarification is needed. These matters are adequately clarified by the Chairman and/or CEO and/or any other officer. |

|||||||||||||||

| 3 (5) (xi) | The Chief Executive Officer shall function as the apex executive-in-charge of the day-to-day management of the Bank’s operations and business. |

Complied with.

The CEO is supported by the members of the Corporate Management to manage the day-to-day management of the Bank’s operations and business. |

|||||||||||||||

3 (6) - Board Appointed Committees |

|||||||||||||||||

| 3 (6) (i) | Each bank shall have at least four Board Committees as

set out in Directions 3 (6) (ii), 3 (6) (iii), 3 (6) (iv) and 3 (6) (v) of these Directions. Each Committee shall report directly to the Board. All Committees shall appoint a Secretary to arrange the meetings and maintain minutes, records, etc., under the supervision of the Chairman of the Committee. The Board shall present a report of the performance on each Committee, on their duties and roles at the Annual General Meeting. |

Complied with.

The following mandatory Board Sub-Committees have been appointed by the Board, which requires each such committee to report to the Board:

In addition, the Board has appointed the following Sub-Committees too: |

|||||||||||||||

| 3 (6) (ii) | The following rules shall apply in relation to the Audit Committee: | See Sections of Composition, Charter, Meetings and the Methodology of the Board Audit Committee Report. | |||||||||||||||

| (a) The Chairman of the Committee shall be an Independent Non-Executive Director who possesses qualifications and experience in accountancy and/or audit. | Complied with.

Chairman of the Committee is an Independent Non-Executive Director and possesses qualifications and related experience. |

||||||||||||||||

| (b) All members of the Committee shall be Non-Executive Directors. | Complied with.

All members of the Committee are Non-Executive Directors. |

||||||||||||||||

| (c) The Committee shall make recommendations on matters in connection with:

(i) The appointment of the External Auditor for audit services to be provided in compliance with the relevant statutes; |

Complied with. |

||||||||||||||||

| (ii) the implementation of the Central Bank guidelines issued to Auditors from time to time;

(iii) the application of the relevant accounting standards; and (iv) the service period, audit fee and any resignation or dismissal of the Auditor; provided that the engagement of the Audit Partner shall not exceed five years, and that the particular Audit Partner is not re-engaged for the audit before the expiry of three years from the date of the completion of the previous term. |

The evaluation is carried out by the Board Audit Committee in consultation with the Chief Financial Officer. | ||||||||||||||||

| (d) The Committee shall review and monitor the External Auditor’s independence and objectivity and the effectiveness of the audit processes in accordance with applicable standards and best practices. | Complied with.

The Board has adopted a policy of rotation of Auditors, once in every 5 years, in keeping with the principles of good Corporate Governance. |

||||||||||||||||

(e) The Committee shall develop and implement a policy on the engagement of an External Auditor to provide non-audit services that are permitted under the relevant statutes, regulations, requirements and guidelines. In doing so, the Committee shall ensure that the provision by an External Auditor of non-audit services does not impair the External Auditor’s independence or objectivity. When assessing the External Auditor’s independence or objectivity in relation to the provision of non-audit services, the Committee shall consider:

|

Complied with.

Following action is taken prior to the assignment of non-audit services to External Auditors by the Bank:

|

||||||||||||||||

| (f) The Committee shall, before the audit commences,

discuss and finalise with the External Auditors the nature and

scope of the audit, including:

(i) an assessment of the Bank’s compliance with the relevant Directions in relation to corporate governance and the management’s internal controls over financial reporting; (ii) the preparation of Financial Statements for external purposes in accordance with relevant accounting principles and reporting obligations; and (iii) the co-ordination between firms where more than one audit firm is involved. |

Complied with. The Auditors make a presentation at the Board Audit Committee meeting with details of the proposed Audit Plan and the Scope. Members of the Board Audit Committee obtain clarifications in respect of the contents of the presentation, if deemed necessary. |

||||||||||||||||

| (g) The Committee shall review the financial information of the Bank, in order to monitor the integrity of the Financial Statements of the Bank, its Annual Report, accounts and quarterly reports prepared for disclosure, and the significant financial reporting judgments contained therein. In reviewing the Bank’s Annual Report and accounts and quarterly reports before submission to the Board, the Committee shall focus particularly on: (i) major judgmental areas; (ii) any changes in accounting policies and practices; (iii) significant adjustments arising from the audit; (iv) the going concern assumption; and (v) the compliance with relevant accounting standards and other legal requirements. |

Complied with. Quarterly Financial Statements as well as year end Financial Statements are circulated to all members of the Board Audit Committee. A detailed discussion takes place at the Board Audit Committee meeting regarding such Financial Statements. Once the members of the Board Audit Committee have obtained required clarifications in respect of all aspects included in the Financial Statements, such Financial Statements are recommended for approval by the Board of Directors. |

||||||||||||||||

| (h) The Committee shall discuss issues, problems and reservations arising from the interim and final audits and any matters the Auditor may wish to discuss including those matters that may need to be discussed in the absence of Key Management Personnel, if necessary. |

Complied with The Committee met the External Auditors without the presence of the Executive Directors and Corporate Management. |

||||||||||||||||

| (i) The Committee shall review the External Auditor’s Management Letter and the management’s response thereto. | Complied with.

Upon receipt of the interim Management Letter and year end Management Letters, Auditors are invited to make a presentation at a Board Audit Committee meeting to discuss significant findings which have arisen during the audit. Thereafter, the Board Audit Committee decides on remedial action to be taken in respect of such findings, if any, and relevant Heads of Departments are instructed to take such action. |

||||||||||||||||

|

Complied with. The Annual Audit Plan prepared by the Internal Audit Department is submitted to the Board Audit Committee for approval. This plan covers the scope and resource requirement relating to the Audit Plan. |

||||||||||||||||

|

Complied with. | ||||||||||||||||

|

Complied with. The services of 5 audit firms have been obtained to assist the Inspection Department to carry out the audit function. Prior approval of the Board Audit Committee has been obtained in this regard. |

||||||||||||||||

|

Complied with | ||||||||||||||||

|

Complied with. Internal Audit Department reports direct to DGM Management Audit who will be reporting directly to the Board Audit Committee. Hence, it is independent. The audits are performed with impartiality, proficiency and due professional care. |

||||||||||||||||

| (k) The Committee shall consider the major findings of internal investigations and management’s responses thereto. | Complied with. Significant findings of investigations carried out by the Inspection Department along with the responses of the Management are tabled and discussed at Board Audit Committee meetings. |

||||||||||||||||

| (l) The Chief Finance Officer, the Chief Internal Auditor and a representative of the External Auditors may normally attend meetings. Other Board Members and the Chief Executive Officer may also attend meetings upon the invitation of the Committee. However, at least twice a year, the Committee shall meet with the External Auditors without the Executive Directors being present. | Complied with. The immediate requirement of two meetings between the Board Audit Committee and External Auditors has been met. In addition, the Non-Executive Directors have been provided with an opportunity of discussing matters relating to audit on a private basis. |

||||||||||||||||

| (m) The Committee shall have: (i) explicit authority to investigate into any matter within its terms of reference; (ii) the resources which it needs to do so; (iii) full access to information; and (iv) authority to obtain external professional advice and to invite outsiders with relevant experience to attend, if necessary. | Complied with. Please refer ‘Board Audit Committee Report’. |

||||||||||||||||

| (n) The Committee shall meet regularly, with due notice of issues to be discussed and shall record its conclusions in discharging its duties and responsibilities. | Complied with. Please refer ‘Board Audit Committee Report’. |

||||||||||||||||

| (o) The Board shall disclose in an informative way; (i) details of the activities of the Audit Committee; (ii) the number of Audit Committee meetings held in the year; and (iii) details of attendance of each individual Director at such meetings. | Complied with. Please refer ‘Board Audit Committee Report’. |

||||||||||||||||

| (p) The Secretary of the Committee (who may be the Company Secretary or the Head of the Internal Audit function) shall record and keep detailed minutes of the Committee meetings. | Complied with. The Secretary of the Committee records and maintains all minutes of the meetings. |

||||||||||||||||

| (q) The Committee shall review arrangements by which employees of the Bank may, in confidence, raise concerns about possible improprieties in financial reporting, internal control or other matters. Accordingly, the Committee shall ensure that proper arrangements are in place for the fair and independent investigation of such matters and for appropriate follow-up action and to act as the key representative body for overseeing the Bank’s relations with the External Auditor. | Complied with. The Bank has a Whistle-Blowing Policy which has been reviewed and approved by the Board Audit Committee and the Board of Directors. |

||||||||||||||||

| 3 (6) (iii) | The following rules shall apply in relation to the Human Resources and Remuneration Committee: | Please refer Sections of Composition, Charter, Meetings and the Methodology of the ‘Board Human Resources and Remuneration Committee Report’. | |||||||||||||||

| (a) The Committee shall determine the remuneration policy (salaries, allowances and other financial payments) relating to Directors, Chief Executive Officer (CEO) and Key Management Personnel of the Bank. | Complied with. |

||||||||||||||||

| (b) The Committee shall set goals and targets for the Directors, CEO and the Key Management Personnel. | |||||||||||||||||

| (c) The Committee shall evaluate the performance of the CEO and Key Management Personnel against the set targets and goals periodically and determine the basis for revising remuneration, benefits and other payments of performance based incentives. | |||||||||||||||||

| (d) The CEO shall be present at all meetings of the Committee, except when matters relating to the CEO are being discussed. | |||||||||||||||||

| 3 (6) (iv) | The following rules shall apply in relation to the Board Nomination Committee: | ||||||||||||||||

| (a) The Committee shall implement a procedure to select/appoint new Directors, CEO and Key Management Personnel. | Complied with. |

||||||||||||||||

| (b) The Committee shall consider and recommend (or not recommend) the re-election of current Directors, taking into account the performance and contribution made by the Director concerned towards the overall discharge of the Board’s responsibilities. | |||||||||||||||||

| (c) The Committee shall set the criteria such as qualifications, experience and key attributes required for eligibility to be considered for appointment or promotion to the post of CEO and the key management positions. | |||||||||||||||||

| (d) The Committee shall ensure that Directors, CEO and Key Management Personnel are fit and proper persons to hold office as specified in the criteria given in Direction 3 (3) and as set out in the Statutes. | Complied with.

The Board Nomination Committee ensures that all Directors are fit and proper persons to hold office as specified in the Direction. The Board Human Resources and Remuneration Sub-Committee ensures that Key Management Personnel are fit and proper persons to hold office as specified in the Direction. |

||||||||||||||||

| (e) The Committee shall consider and recommend from time to time, the requirements of additional/new expertise and the succession arrangements for retiring Directors and Key Management Personnel. | For Directors - Complied with.

For Key Management Personnel - This activity is handled by the Board Human Resources and Remuneration Committee. |

||||||||||||||||

| (f) The Committee shall be chaired by an Independent Director and preferably be constituted with a majority of Independent Directors. The CEO may be present at meetings by invitation. | Committee was chaired by an Independent Director.

CEO was present at meetings by invitation. |

||||||||||||||||

| 3 (6) (v) | The following rules shall apply in relation to the Integrated Risk Management Committee: | Please refer Sections of Composition, Charter, Meetings and the Methodology of the ‘Board Integrated Risk Management Committee Report’. | |||||||||||||||

| (a) The Committee shall consist of at least three Non-Executive Directors, Chief Executive Officer and Key Management Personnel supervising broad risk categories - i.e., credit, market, liquidity, operational and strategic risks. The Committee shall work with Key Management Personnel very closely and make decisions on behalf of the Board within the framework of the authority and responsibility assigned to the Committee. | Complied with.

Members of the Board Integrated Risk Management Committee (BIRMC) are given below: - Mr. K.G.D.D. Dheerasinghe - Chairman - Mr. W.M.R.S. Dias - Prof. U.P. Liyanage - Mr. L. Hulugalle - Mr. S. Swarnajothi - Mr. M.P. Jayawardena - Mr. J. Durairatnam - Mr. K.D.N. Buddhipala - Mr. S.C.U. Manatunga |

||||||||||||||||

| (b) The Committee shall assess all risks - i.e., credit, market, liquidity, operational and strategic risks to the Bank on a monthly basis through appropriate risk indicators and management information. In the case of Subsidiary Companies and Associate Companies, risk management shall be done, both on a Bank basis and Group basis. | Complied with. | ||||||||||||||||

| (c) The Committee shall review the adequacy and effectiveness of all management level committees such as the Credit Committee and the Asset-Liability Committee to address specific risks and to manage those risks within quantitative and qualitative risk limits as specified by the Committee. | Complied with. The Committee minutes evidence that all risk indicators such as key operational risk indicators, non-financial operating risk indicators, analysis of NPA ratio and default ratios, high risk sector advances/NPA segmentation by industry and risk grading, cross border and counterparty risk exposures have been reviewed on a monthly basis. Further, adequacy and effectiveness of all management level risk-related committees such as Executive Integrated Risk Management Committee, ALCO, Credit Policy Committee and Executive Committee on Monitoring NPAs are reviewed by the BIRMC annually. |

||||||||||||||||

| (d) The Committee shall take prompt corrective action to mitigate the effects of specific risks in the case such risks are at levels beyond the prudent levels decided by the Committee on the basis of the Bank’s policies and regulatory and supervisory requirements. | Complied with. Actual exposure levels under each risk category are monitored against the tolerance levels when preparation of ‘Risk Profile Dashboard’ of the Bank which is circulated among members of the BIRMC on a monthly basis and discussed in detail at quarterly meetings. Recommendations/suggestions are also discussed if any risk indicator exceeds the tolerance limits and the progress of rectification of the position and implementation of the recommendations are being monitored closely. |

||||||||||||||||

| (e) The Committee shall meet at least quarterly to assess all aspects of risk management including updated business continuity plans. | Complied with. | ||||||||||||||||

| (f) The Committee shall take appropriate actions against the officers responsible for failure to identify specific risks and take prompt corrective actions as recommended by the Committee, and/or as directed by the Director of Bank Supervision. | Committee refers such matters, if any, to the HR Department for necessary action. | ||||||||||||||||

| (g) The Committee shall submit a risk assessment report within a week of each meeting to the Board seeking the Board’s views, concurrence and/or specific Directions. | Complied with. | ||||||||||||||||

| (h) The Committee shall establish a compliance function to assess the Bank’s compliance with laws, regulations, regulatory guidelines, internal controls and approved policies on all areas of business operations. A dedicated compliance officer selected from Key Management Personnel shall carry out the compliance function and report to the Committee periodically. | Complied with. Compliance function is in place to assess the Bank’s compliance with external and internal regulations. The Compliance Officer submits a Positive Assurance Certificate on Compliance with Mandatory Banking and Other Statutory Requirements on quarterly basis to the Board Audit Committee and the Board Integrated Risk Management Committee. Any significant matters are discussed in detail at the committee meetings and instructions are issued to respective departments for remedial action. |

||||||||||||||||

3 (7) - Related Party Transactions |

|||||||||||||||||

| 3 (7) (i) | The Board shall take the necessary steps to avoid any conflicts of interest that may arise from any transaction of the Bank with any person, and particularly with the following categories of persons who shall be considered as ‘related parties’ for the purposes of this Direction:

|

All members of the Board are required to make declaration of the positions held with related parties at the time of appointment and thereafter this is further reviewed annually. This information is provided to the Finance Division enabling them to capture relevant transactions. In the event of any change (during the year) the Directors are required to make a further declaration to the Company Secretary. The Bank is taking initiatives to further strengthen the monitoring mechanism. Directors refrain from participating at relevant sessions in which lending to related entities are discussed to avoid any kind of an influence. Transactions carried out with related parties in the normal course of business are disclosed in Note 53 to the Financial Statements on ‘Related Party Disclosures’. |

|||||||||||||||

| 3 (7) (ii) | The type of transactions with related parties that shall be covered by this Direction shall include the following:

|

A Board approved process is in place to ensure compliance.

The Bank is in the process of strengthening the monitoring mechanism in this regard during the year 2014. |

|||||||||||||||

| 3 (7) (iii) | The Board shall ensure that the Bank does not engage in transactions with related parties as defined in Direction 3 (7) (i) above, in a manner that would grant such parties ‘more favourable treatment’ than that accorded to other constituents of the Bank carrying on the same business. In this context, ‘more favourable treatment’ shall mean and include treatment, including the:

(a) Granting of ‘total net accommodation’ to related parties, exceeding a prudent percentage of the Bank’s regulatory capital, as determined by the Board. For purposes of this sub-direction:

|

A Board approved process is in place to ensure compliance. |

|||||||||||||||

| (b) Charging of a lower rate of interest than the Bank’s best lending rate or paying more than the Bank’s deposit rate for a comparable transaction with an unrelated comparable counterparty. | |||||||||||||||||

| (c) Providing of preferential treatment, such as favourable terms, covering trade losses and/or waiving fees/commissions, that extend beyond the terms granted in the normal course of business undertaken with unrelated parties. | |||||||||||||||||

| (d) Providing services to or receiving services from a related party without an evaluation procedure. | |||||||||||||||||

| (e) Maintaining reporting lines and information flows that may lead to sharing potentially proprietary, confidential or otherwise sensitive information with related parties, except as required for the performance of legitimate duties and functions. | |||||||||||||||||

| 3 (7) (iv) | A Bank shall not grant any accommodation to any of its Directors or to a close relation of such Director, unless such accommodation is sanctioned at a meeting of its Board of Directors, with not less than two-thirds of the number of Directors other than the Director concerned, voting in favour of such accommodation. This accommodation shall be secured by such security as may from time to time be determined by the Monetary Board as well. | All accommodations to Directors and/or their close relatives are approved either at a Board meeting or through circulation of Board Papers. | |||||||||||||||

| 3 (7) (v) | (a) Where any accommodation has been granted by a Bank to a person or a close relation of a person or to any concern in which the person has a substantial interest, and such person is subsequently appointed as a Director of the Bank, steps shall be taken by the Bank to obtain the necessary security as may be approved for that purpose by the Monetary Board, within one year from the date of appointment of the person as a Director. | No such situation has arisen during the year. |