Business Model and Strategic Imperatives for Value Creation

The strategic snapshot of the initiatives undertaken by the Bank during the year along with future actions is summarised here.

Strategic Imperative 01 - Prudent Growth

| Strategies to Achieve this Imperative |

|

|

|

|

|

|

The business of a financial institution differs dramatically from that of any other enterprise. The principal differentiator is that the Return On Assets (ROA) achieved by a bank is far lower than for other businesses. ROA in the financial services industry hovers around 2%, whereas it can be as high as 20% in other sectors. However, in order to remain attractive to investors, a financial institution must generate a Return On Equity (ROE) comparable to that of other publicly traded companies. Banks meet this challenge by reaching higher levels of gearing. The ability to accept public deposits makes it possible for banks to gear the ROA to a comparatively higher level in relation to shareholders’ equity.

The following table presents Commercial Bank’s ROA, levels of gearing and ROE over the past five years:

| 2013 | 2012 | 2011 | 2010 | 2009 | |

| ROA (%) | 1.87 | 2.12 | 1.94 | 1.60 | 1.43 |

| Gearing (times) | 9.84 | 9.89 | 10.45 | 11.17 | 11.07 |

| ROE (%) | 18.40 | 20.96 | 20.28 | 17.87 | 15.83 |

Gearing essentially involves growing the bank’s business by attracting customer deposits and then lending those funds to prospective borrowers. The extent to which we can expand our operations, thereby ‘deriving value’ through sustainable growth, invariably depends on our success in ‘delivering value’ and/or creating opportunities to do so in the future.

Initiatives Taken by Business Units to Achieve Prudent Growth

The Bank’s main business units, viz. Personal Banking Division, Corporate Banking Division, Treasury and International Operations with the support service units tirelessly work towards achieving prudent growth. A detailed review of the initiatives taken by the Bank during the year is presented below.

Personal Banking Division

The Personal Banking Division manages the Bank’s national network of delivery points, meeting the needs of individual customers, small and medium-sized enterprises (SMEs) as well as large corporates across the country.

Traditional brick-and-mortar branches still play a dominant role in Sri Lankan banking industry. Over the past few years, Commercial Bank has invested substantially in improving the physical infrastructure of our network. While we’ve been working hard to migrate customers to more technologically advanced channels, we’ve also continued expanding our physical network to reach a wider base in all geographical locations. Please refer Scale of Operations for a complete view of the Bank’s delivery network.

Delivery Points

With our extensive reach, Commercial Bank is truly a national bank. In 2013, 8 delivery points were added in the form of new branches. At the year end, the Bank provided its services through a total of 235 delivery points in Sri Lanka as presented on the Organisational Profile.

Our island-wide network is organised into 14 administrative regions, with decentralised decision-making on credit transactions and day-to-day branch operations.

To deliver convenience for customers, the Personal Banking Division also manages the delivery of 365-day/holiday banking, weekend banking and priority banking services. The Bank operates an ‘Elite’ branch in Colombo 7, serving both high-net-worth and priority banking customers. Given below is number of such delivery points operated by the Personal Banking Division.

| Delivery Points | Number |

| 365-day/Holiday banking centres | 20 |

| Weekend banking centres | 22 |

| Priority banking centres | 3 |

Deposit Mobilisation

A diversified branch network, stable capitalisation, good governance and a strong corporate image have contributed in building a solid deposit base. We recorded substantial growth in deposits during the year, despite a decline in deposit rates and high activity in the debt market driven by several new debenture issues, which absorbed considerable amount of the market’s liquidity. The Bank was compelled to re-price its term deposit products several times during the year to be in line with the market rates and be competitive.

Over the past year, the Personal Banking Division recorded a deposit growth of 13.71% or Rs. 41.3 Bn. -

an average increase of Rs. 3.4 Bn. a month. The branch network recorded approximately 10% growth in the new deposit accounts opened during the year.

The Bank conducted a successful deposit mobilisation campaign - ‘Savings Fiesta’ across the network in June 2013 with a view to create an awareness among people on the importance of savings and thereby attract new depositors. Savings Fiesta was a great success and established many valuable customer relationships.

Personal Loans

Faced with increased risk arising from comparatively higher growth in NPA, Commercial Bank has adopted a selective approach in granting loans. The Bank strongly promoted our ‘top-up’ borrowing facility among its high-net-worth customers, the main pillar of our personal loans portfolio.

During the past year, we granted 9,666 new loans totalling Rs. 5,391.0 Mn. In addition, approximately Rs. 700.0 Mn. worth of new personal loans were granted under a special loans scheme for identified professionals. The non-performing loans ratio within our personal loan portfolio recorded an increase when compared to the last year.

Leasing

During the year, we launched a special marketing campaign promoting Commercial Bank’s leasing product, boosting consumer recall and attracting new customers. However, leasing business was affected by increased import duties on motor vehicles and reduced overall demand for commercial vehicles. As an alternative product the Bank launched Hire Purchase Financing for registered vehicles.

Despite granting more than 1,800 new facilities, we recorded an overall drop of 14% in our leasing portfolio in the past year. The non-performing ratio of the leasing portfolio recorded an increase when compared to the previous year.

Domestic Factoring

Factoring is now widely accepted as an effective mode of financing for small and medium-size enterprises (SMEs). Factoring and similar asset-backed financing products have gained impressive momentum in emerging markets including Sri Lanka and this trend is expected to continue.

Although the Bank proceeded cautiously due to concerns relating to customer receivables and introduced measures to reduce exposure levels, the factoring turnover at the year-end recorded Rs. 14.27 Bn., which represented a growth of over 18% compared to the previous year.

Home Loans

Suspension of fixed-interest rates offered to housing loans in mid 2012, affected the growth of loans in early part of 2013. However, reintroducing the fixed rate product in 2013 eased the impact. We also introduced a unique concept branded ‘Speed Home Loans’, approving of housing loans within three working days. Further, we arranged to offer discounts up to 35% on selected building materials, working in partnership with several suppliers.

Increased demand for apartments and condominiums kick-started a number of condominium building projects over the past year. These projects and a series of strategic tie-ins paved the way for Commercial Bank to extend sizeable amount of home loan facilities, especially to Sri Lankans employed abroad - many of whom contribute significantly to the growth of Bank’s loan portfolio.

The following table summarises recent growth in the home loan portfolio:

| Home Loans | 2013 | 2012 |

| Portfolio (Rs. Bn.) | 26.652 | 25.092 |

| Growth rate (%) | 6.21 | 15.00 |

The Government Budget Proposal for 2014 introduced several incentives for promoting construction of condominiums, most notably granting concessions to professionals who collectively construct condominiums with bank financing. The proposed measures would also help to inject new life into the housing loan market.

Agriculture and Microfinance Loans

Through our branch network, Commercial Bank continues to offer a wide array of agricultural loans and micro financing for businesses. In addition, the Bank participated in several refinance credit schemes and interest-subsidised credit programmes, all focused on supporting Sri Lanka’s agriculture and livestock industries.

In 2013, we also introduced a new loan product, Commercial Agriculture Development Credit Line for professionals, designed to encourage Sri Lankan professionals and executives to explore new opportunities in the field of agriculture. This product is expected to do well specially among the branches in the Western Province.

Microfinance borrowers in some parts of the country faced difficulties in repaying credit facilities because of multiple borrowings and adverse weather conditions, particularly in the middle of the year. Despite growth in performance of the agricultural sector, our microfinance portfolio recorded a slight decline in 2013.

With the addition of three more units in 2013, the Bank now operates a network of 12 dedicated agriculture and microfinance centres. The Bank continued to conduct programmes designed to promote financial inclusion, especially in the Northern and the Eastern Provinces.

Industrial Loans

In 2013, four out of five industrial credit lines financed by the Bank were refinanced by various funding agencies, including the Central Bank of Sri Lanka. Commercial Bank funds the DIRIBALA loan scheme, targeting SMEs with its flexible terms and conditions, particularly those relating to repayment.

The Bank experienced a significant increase in volumes after a campaign to promote development loans offering flexible terms - with a special focus on manufacturing businesses. Over 500 new loans exceeding Rs. 5.0 Bn. were granted during the year.

With the collaboration of the Central Bank, we also carried out a series of entrepreneurship development programs, aiming to improve financial literacy and business skills. Approximately 600 entrepreneurs participated in these programmes.

Pawning

Pawning advances have gained popularity among certain sections of population, especially in the agriculture and fishing sectors, that use pawning as their preferred method of raising-capital. We currently operate 187 fully-fledged pawning centres, having opened two new locations in 2013.

Due to intense competition in the market, the average value of loans granted against gold value increased during the early part of the year, disregarding the underlying risk. When the prices of gold dropped

in April 2013 due to fall in international prices,

it caused many unsecured exposures.

The pawning portfolio of Commercial Bank is relatively small since we were late entrants to the industry and adopted a cautious approach in granting pawning advances. Even so, the Bank’s non-performing pawning advances ratio increased to 15.54% from 3.07% at the end of 2012.

Payment Cards

Strengthening our position as the market leader in debit cards, Commercial Bank issued more than 400,000 new cards in 2013 - a growth of over 16% compared to the previous year, achieving a record total of more than three million cards in use. This contributed to a growth exceeding 30% in debit card purchases which resulted in substantial increase in interchange income compared to 2012.

Credit card purchase volumes saw a moderate growth in 2013 following the aggressive growth of approximately 30% recorded in the previous year. The Bank rolled out many successful credit and debit card promotional campaigns in 2013, encouraging cardholders to use credit/debit cards by offering discounts at various restaurants, hotels, clothing retailers and bookstores.

Last year, we added two new card products to our well-diversified portfolio: the Udara card and the Achievers card. At the same time, we began enrolling credit and debit cardholders for SMS alerts. In 2013, we entered into agreements with two finance companies and a bank to issue ATM and debit cards. Our Goldnet ATM switch also provides a gateway to international and local transactions through other networks such as Visa International.

e-Banking

The launch of an iOS application, which provides iPhone and iPad users the ability to access Commercial Bank’s Online banking facility was the main highlight during the year. Further, the Bank’s Bangladesh operation introduced the Internet Banking personal application, developed on Microsoft.Net, enabling access to the same banking features. The e-banking division also introduced a USSD - based mobile banking application for Dialog subscribers.

In 2013, Commercial Bank also began to support mobile money products such as EzCash by Dialog and mCash by Mobitel, enabling subscribers to top up their mobile wallets directly from their bank accounts. In partnering with Mobitel, we act as custodian bank for mCash.

PayMaster

ComBank PayMaster is a complete online payment solution that enables large corporate clients to make bulk bill payments through a single mechanism. Over the years, we’ve made significant improvements to this service, which now caters to a wide customer base of medium to large corporations.

The popularity of this product is clearly visible in the following statistics:

| Product | Customer Base Growth | Income Growth |

| % | % | |

| ComBank PayMaster | 28 | 20 |

| Product | Transaction Growth | Volume Growth |

| % | % | |

| ComBank PayMaster | 12 | 15 |

Bancassurance

The Bank witnessed a significant growth in life insurance operation, despite the modest growth in the insurance industry which was hampered due to the low credit growth that prevailed in the country.

Commercial Bank has entered into new agreements with two leading insurance companies to promote their life and general insurance products under the Bancassurance label.

Supermarket Banking

As the Sri Lankan pioneer and market leader in supermarket banking, Commercial Bank has successfully differentiated this service from those of other banks by adopting customer-centric operating models that vary by branch type and location. As some supermarket branches have moved to standalone locations outside the retail environment, we’ve seen increases in both customer patronage and banking transactions, resulting improvement in overall business volumes.

Many of Commercial Bank’s clients prefer to do their banking at supermarket locations because of the efficient and personalised service provided by our dedicated branch staff. We now operate 27 supermarket outlets, including five that were opened in 2013.

Commercial Bank Elite

Commercial Bank Elite is an exclusive priority banking service for high-net-worth individuals. The Elite concept meets the three key expectations of discerning customers, delivering banking services distinguished by their convenience, superior quality and degree of personalisation.

Commercial Bank Elite has its own private residence at No. 7, R.G. Senanayake Mawatha (Gregory’s Road), Colombo 07, with specially trained relationship officers who can address the full spectrum of financial needs. Elite customers enjoy many unique benefits and privileges, including premium services provided by other partners of the Bank.

Commercial Bank also operates two other priority centres at our Reid Avenue and Peradeniya branches.

| Highlights of 2013 |

|

|

|

|

The following table shows the key performance indicators for Personal Banking division in 2013:

| Key Performance Indicators | Actual 2013 Rs. Mn. |

Budget 2013 Rs. Mn. |

Actual 2012 Rs. Mn. |

Achievement (Actual over Budget) % |

| Deposits as at December 31, | 342,540.4 | 355,542.0 | 301,251.4 | 96.3 |

| Loans & advances as at December 31, | 192,835.4 | 232,854.5 | 191,498.5 | 82.8 |

| Profit before tax | 7,147.0 | 7,629.4 | 6,996.4 | 93.7 |

| Cost Income ratio (%) | 48.6 | 50.0 | 47.0 | |

| NPA ratio as at December 31, (%) | 7.6 | 5.0 | 5.5 |

The above analysis includes the performance of the Card Centre and e-banking unit although these units operate independent to the Personal Banking Division.

Amidst the challenging market environment, the Personal Banking division recorded satisfactory results during the year. The contribution made by the branch network immensely helped the Bank to achieve its corporate objectives.

Corporate Banking Division

Commercial Bank’s dedicated Corporate Banking division includes Foreign Branch, Off-shore Banking, Islamic Banking and Corporate Finance units.

Over the years, the Foreign Branch has earned a reputation for providing expert trade finance support to a diverse business clientele, including medium and large Sri Lankan corporations, as well as blue-chip companies and multinationals operating in the country. Excess funds mobilised through the Personal Banking division are mainly channelled to Foreign Branch customers through the Corporate Banking division. Corporate Banking division also overlooks the Bank’s credit operations in Bangladesh and does selective lending in the Maldives.

Commercial Bank has a well-established and trusted network of correspondents around the world. This long-standing relationship has provided a distinct advantage to the customers of the Bank in conducting their international business with global counterparts.

Sri Lanka has seen a boom in development activities and mega-infrastructure projects undertaken by the Government. The Bank’s Investment Fund Account, built with tax savings announced in the Government Budget 2011, has been used primarily by the Corporate Banking unit in supporting government initiatives to develop the road network of the country. Further, the Fund also disbursed loans for factory modernisation and hotel projects.

Import Business

Sri Lanka’s rapidly developing tourism and construction industries have increased imports of heavy-duty machinery and equipment. Further the growth in the SME sector indirectly impacted the increase in import volumes due to its use of raw materials.

Last year the Government imposed a 100% margin on certain categories of motor vehicles and spare parts, which hindered import turnover in the banking industry. However, this requirement was lifted in mid 2013.

Sri Lanka’s import volumes recorded a marginal decrease to US $ 19.0 Bn. in 2013, compared to US $ 19.1 Bn. in 2012. Commercial Bank’s import turnover increased marginally to US $ 1,379.6 Mn., compared to the last year.

Export Business

Sri Lankan exports fared well in 2013, buoyed by strong prices for tea, increased demand for natural rubber, spices, coconut-based products, and the depreciation of the rupee towards the end of the year.

Export turnover of the Bank increased to US$ 1,832.0 Mn. from US$ 1,728.0 Mn. a growth of 6% which was in line with the country’s growth in 2013. The country’s growth was achieved despite the slow economic recovery in the European Union, the United States and the prevailing crisis situation in the Middle East.

Corporate Finance

Commercial Bank’s margin trading operations, launched in 2010 as a key capital markets product, were subdued in 2013 owing to adverse market conditions. The weak performance of the stock market was not sufficiently countered by the general improvement in credit conditions and interest rates during the year.

While the Bank’s equity funds performed positively, they did not do as well as they would have under more favourable market conditions. The Bank focused on private equity structuring to secure investments from high-net-worth and institutional investors in unlisted company offerings -

demand for which is not closely tied to public investor demand for IPOs. The year was marked overall by extensive investments in listed debentures, most of which were successful as a result of the special tax concessions afforded to them.

In 2013, Commercial Bank marketed transaction-processing services to selected high-net-worth and institutional customers, securing several key mandates. Transaction-processing services provided by the Corporate Finance unit include settlement of customers’ stock market transactions, as well as making investments in debt securities and receiving maturity and interest proceeds on customers’ behalf. These services are purely transactional; no investment advice is offered.

Islamic Banking

Islamic deposit products, such as Mudaraba savings and investment accounts, along with asset products such as Murabaha, Musharaka, diminishing musharaka, Ijara leasing and import financing are available in the local market.

Bank’s Islamic Banking Unit (IBU) also took initiatives to introduce Wakala as an

asset product, which is offered to selected Islamic customers based on their risk profile. IBU received a gold award as ‘Emerging Entity of the Year’ at the inaugural ‘Sri Lanka Islamic Banking and Finance Industry Awards’, held in October 2013.

Bullion Trading

Commercial Bank offers facilities for online gold trading, night time gold fixing, pawning and custodial service. In 2013, transactions with reputable gold suppliers helped us achieve sustainable growth in the business volumes handled by our bullion trading centre.

The business environment for bullion trading was favourable up to June 2013. However, the Government imposed new taxes that affected our business performance - which was further challenged by exchange rate fluctuations.

The following table shows the key performance indicators of Corporate Banking division in 2013:

| Key Performance Indicators | Actual 2013 Rs. Mn. |

Budget 2013 Rs. Mn. |

Actual 2012 Rs. Mn. |

Achievement (Actual over Budget) % |

| Advances as at December 31 | 135,282.5 | 133,813.1 | 109,664.2 | 101.1 |

| Profit before tax | 5,102.1 | 5,026.9 | 4,192.5 | 101.5 |

| Import turnover | 180,729.8 | 151,941.4 | 177,894.0 | 118.9 |

| Export turnover | 240,053.8 | 253,494.5 | 225,396.5 | 94.7 |

| Cost Income ratio (%) | 18.8 | 20.2 | 20.1 | |

| NPA ratio (%) as at December 31 | 0.9 | 1.9 | 1.2 |

The Corporate Banking Division recorded significant growth in advances during 2013, achieving most of its budgeted targets set for the year. Further, the Division has been continuously able to maintain a low NPA ratio of 0.9% for 2013, which is an improvement from the ratio of 1.2% reported in 2012.

| Highlights of 2013 |

|

|

|

Treasury

The Treasury Department, a separate profit centre within Commercial Bank, is responsible for management of the Bank’s liquidity, interest rates, funding, capital and foreign exchange exposures. The department’s main sources of income are foreign exchange profits, income from investments and trading of government securities, and cross-currency trading of US dollars and Sri Lankan rupees.

The below chart gives a brief summary of the performance of the Bank’s Treasury Division:

| Key Performance Indicators | Actual 2013 Rs. Mn. |

Budget 2013 Rs. Mn. |

Actual 2012 Rs. Mn. |

Achievement (Actual over Budget) % |

| Interest income | 13,992.1 | 11,656.7 | 9,304.0 | 120.0 |

| Foreign exchange profit | 1,070.1 | 620.2 | 2,856.1 | 172.5 |

| Profit before tax | 460.9 | 376.6 | 1,490.0 | 122.4 |

| Interest earning assets as at December 31 | 173,716.7 | 132,538.3 | 118,181.2 | 131.07 |

| Cost Income ratio (%) | 38.9 | 43.3 | 28.2 |

As evident from the above, Treasury is entrusted with increased volumes due to lack of credit demand in the country. Despite the shrinking interest margins, Treasury performed reasonably well and achieved majority of the targets set at the beginning of the year.

| Highlights of 2013 |

|

|

|

|

A major portion of last year’s exchange profit was earned from trade-related transactions and remittances. Corporate sales posted better than expected results, mainly due to increased trade volumes and healthy margins. Exchange rate volatilities prevailing in the Sri Lankan economy during the year augured well for the US$/LKR foreign exchange market, enabling Treasury to book substantial exchange gains by managing FOREX trades.

In 2013, Treasury undertook the management of foreign currency funds borrowed from the International Finance Corporation through a foreign currency swap. US $ 140 Mn. was swapped into Sri Lankan funds and invested profitably in risk-free instruments.

Total government securities volume grew by 81.37% in 2013 to a record Rs. 171.0 Bn., which contributed to a higher interest income in a declining interest rate environment. Treasury increased its US $-denominated government securities portfolio during the year, after Sri Lankan government relaxed exchange control regulations enabling banks to invest in various Sri Lanka Government bond issues which yielded high tax-efficient returns. Treasury held US $ 339.0 Mn. in US $-denominated government securities at the end of the year.

The Treasury Department also acts as the funding centre for the Bank. All financial assets and liabilities are transfer-priced by various business units to Treasury, which is entrusted with managing interest rate risk through the funds-transfer pricing system.

The economic environment in 2013 was not conducive for Commercial Bank to expand its loan book, resulting in excess liquidity been managed by the Treasury, primarily by investing in Government Securities.

The Bank’s liability base comprises of high-rate deposits which were re-priced gradually compared to its asset base. Similarly, a reasonable percentage of loans granted at floating rates were re-priced at lower rates. However, the Bank’s low-cost fund base, including demand deposits and savings deposits, did not re-price downward in a reducing interest rate environment, resulting in shrinking interest margins.

International Operations

Performance of Bangladesh Operation

The financial system of Bangladesh consists of the Bangladesh Bank, four nationalised commercial banks; four Government-owned specialised banks; 37 domestic private banks; nine foreign banks; and 31 non-bank financial institutions. The Government granted nine new commercial banking licenses in the latter part of 2012, which led to the opening of seven banks in 2013.

Our Bangladesh operation which commenced operations with two branches and two booths at the time of acquisition in 2003, has expanded its presence over the past decade to 18 outlets comprising of 10 branches, 2 offshore banking units and 6 SME centres. The bank also has 19 ATMs in the country, which include 4 off-site locations.

Over the past 10 years, Commercial Bank has positioned itself well in relation to the other regional foreign banks operating in Bangladesh. Backed by an extensive array of products, our operation serves a diverse client base with a healthy mix of corporate and retail customers. The business has made a strong contribution to the overall profitability of Commercial Bank.

The following table depicts the success of the Bank’s 10 years of operation in Bangladesh:

| 2003 | 2013 | 10 Year CAGR

(%) |

|

| Deposits (BDT - Mn.) | 3,894.0 | 19,526.65 | 17.50 |

| Gross Loans and Advances (BDT - Mn.) | 2,916.0 | 16,705.12 | 19.07 |

| Profit before tax (BDT - Mn.) | 48.37 | 1,371.00 | |

| Profit after tax (BDT - Mn.) | 18.04 | 833.41 | |

| Return on Assets (%) | 4.69 | 4.99 | |

| Return on Capital Employed (%) | 10.00 | 15.21 | |

| Cost Income ratio (%) | 43.00 | 30.91 | |

| No. of employees | 188 | 211 | |

| No. of branches | 4 | 18 | |

| No. of ATMs | 1 | 19 |

BDT - Bangladesh Taka

During 2013, the Bank opened a new branch, upgraded two of its booths into fully-fledged branches and launched two new deposit products. Further, a proprietary card offered for the Teen Saver’s account was converted into a Visa debit card. Our Bangladesh customers now have access to approximately 3,500 Visa ATMs across the country.

Commercial Bank also has agreements with Prime Bank and Islamic Bank of Bangladesh to carry out cash management services and remittance disbursements through their widely distributed branch networks.

Performance of our Bangladesh Operations during the year, is given below:

| 2013 | 2012 | Growth | Growth (%) | |

| Deposits (BDT Mn.) | 19,526.65 | 18,245.95 | 1,280.70 | 7.02 |

| Loans and advances (BDT Mn.) | 16,705.12 | 16,344.90 | 360.22 | 2.20 |

| Profit before tax (BDT Mn.) | 1,371.00 | 1,151.02 | 219.98 | 19.11 |

| Profit after tax (BDT Mn.) | 833.41 | 648.02 | 185.39 | 28.60 |

| Annual profit per employee (BDT Mn.) | 6.50 | 5.70 | ||

| Return on Assets (%) | 4.99 | 4.31 | ||

| Return on Capital Employed (%) | 15.21 | 13.02 | ||

| Cost Income ratio (%) | 30.91 | 33.04 |

The Bangladesh operation recorded improved results, especially post tax profit grew by more than 28% compared to the last year. Key performance ratios recorded improvements compared to 2012.

Through prudent lending and risk-management practices, Commercial Bank was able to maintain a healthy NPA ratio of 1% until mid 2013, which increased to 1.52% by the end of the year.

All key performance ratios - including Cost-to-income ratio, Return on Assets and Return on Equity - remained healthy during the year. Prudent fund management allowed us to keep our net interest margin in line with the previous year. We have been able to increase the number of accounts, both in deposits and advances, at a steady pace over the years.

Last year, Commercial Bank received the 2012 Best Corporate Performance Award from the Institute of Cost and Management Accountants of Bangladesh, winning for the fourth time in the foreign bank category.

eRemittances

Remittances by migrant Sri Lankans have made an immense contribution to the national economy, partly financing the country’s much-needed foreign exchange requirements. Despite the many informal remittance methods thriving in the market, remitting money via financial institutions has gained popularity, due to the superior level of service. The trend towards more formal remittance channels was further buoyed by the government’s recent implementation of anti-money laundering and know-your-customer practices.

Commercial Bank’s internal money transfer platform, ComBank e-Exchange, is available in most parts of the world, providing migrant workers with a safe, convenient and efficient way to send money home. ComBank e-Exchange is strongly endorsed by the Bank’s business promotion officers stationed in various overseas locations, who also cross-sell Bank’s other products and services.

In light of our wide-ranging e-remittance initiatives, Commercial Bank was adjudged as the most productive network in South Asia for the second consecutive year by MoneyGram, the global funds transfer company, at its annual South Asian Agents Conference held in India in 2013.

ComBank e-Exchange continues to grow, cementing seven new partnerships in 2013. With a total of 83 overseas remittance partners at the end of the year, Commercial Bank now has a 17% market share of worker remittances to Sri Lanka.

| Product | Customer Base Growth

% |

Income Growth

% |

| ComBank e-Exchange | 10 | 15 |

| Product | Transaction Growth

% |

Volume Growth

(US $) % |

| ComBank e-Exchange | 18 | 19 |

The following table shows the key performance indicators of International Operations in 2013:

| Key Performance Indicators | Actual 2013 Rs. Mn. |

Budget 2013 Rs. Mn. |

Actual 2012 Rs. Mn. |

Achievement (Actual over Budget) % |

| Deposits as at December 31, | 41,819.5 | 38,452.4 | 35,820.2 | 108.8 |

| Loans & advances as at December 31, | 36,138.0 | 35,715.7 | 32,647.7 | 101.2 |

| Profit before tax | 2,012.3 | 2,442.7 | 1,657.1 | 82.4 |

| Cost Income ratio (%) | 30.9 | 33.5 | 33.0 | |

| NPA ratio (%) as at December 31, | 1.5 | 1.3 | 3.3 |

For the purposes of above analysis, international operations are defined according to their streams of income generated outside Sri Lanka. Therefore, the total of Bank’s operations in Bangladesh, off-shore banking operations in Maldives and remittance operations of the e-Banking Centre have been included in this analysis.

The total international operations made a satisfactory contribution to the performance of the Bank during the year. Although the total operations did not achieve some of the targets set at the beginning of the year, they achieved satisfactory growth over 2012.

| Highlights of 2013 |

|

|

|

Support Services

At Commercial Bank, we could not have effectively delivered our products and services without vital input from various support service departments. Many of these departments have become specialised units in their own right, of these support service units, we elaborate the operating highlights of a few departments as detailed below:

As a leading private-sector bank, we have fully embraced emerging technologies in order to evolve our quality of service and operational efficiency. That said, Commercial Bank’s bricks-and-mortar locations remain essential to establishing our presence in communities across Sri Lanka. We have invested a substantial value in improving our physical infrastructure over the years.

Marketing

Last year was a busy one for the Bank’s marketing division. A number of campaigns were launched, increasing Commercial Bank’s visibility, building brand equity and sharpening our competitive edge.

Our greatest challenge was to retain accountholders amidst a declining interest rate environment. We attracted new customers by launching ‘The Achiever’, a specialised current account aimed at dynamic young executives, which offers great flexibility and value added features. We also relaunched our existing senior citizens’ account, ‘Udara’, with a new communication strategy. In addition, we launched high-profile promotional campaigns for our women’s savings account, ‘Anagi’, which also saw record-breaking growth during the financial year.

To increase our deposits portfolio, we carried out an extensive month-long ‘Savings Fiesta’ across

all branches island-wide. This mega-savings campaign was launched in June 2013 and offered a range of special account opening gifts to new and existing customers.

A comprehensive advertising campaign supporting Savings Fiesta was conducted through mass media, digital and social media, with highly visible outdoor drives.

The campaign sparked a huge surge in deposit balances and proved to be one of the most successful marketing efforts in the history of the Bank.

Our Arunalu Scholarship Cash Prize campaign also received great publicity by offering an educational support program for three students who scored the highest marks in Sri Lanka. The main winners will receive a monthly cash scholarship until they leave school.

Further, more than Rs. 3.5 Mn. worth of cash prizes were disbursed to fifth-year scholarship winners through our branch network.

Other notable marketing initiatives over the past year include the launch of mobile banking and the relaunch of our online banking service with added features and an improved customer interface.

The latter successfully boosted our total number of online customers to more than 100,000.

The Marketing team also carried out various campaigns and promotional activities to support a wide range of products and services, including Bancassurance, the vehicle leasing and hire-purchase programmes, agriculture and development loans, credit and debit cards, and more. Details of these activities are discussed elsewhere in this report.

Information Technology

Over the past year, a number of non-bank service providers became increasingly active in promoting person-to-person mobile phone payment systems in

Sri Lanka. While these providers have helped in creating heightened consumer interest and, more generally, in building a mobile payments ecosystem, banks can be expected to play a more central role in developing this area of commerce in the years ahead.

In December 2013, Commercial Bank opened a 24-hour automated banking centre at Ward Place, offering several features that were not previously available in Sri Lanka. The unique service allows customers to apply for loans, open accounts, deposit cash and cheques, conduct Internet banking, withdraw cash, and obtain information on our products and services. There is no other service of its kind in Sri Lanka.

Over the past year we continued to deliver on our promise of superior customer convenience by offering:

- Easy banking on the move using the acclaimed Commercial Bank iPhone mobile app.

- Hassle-free currency exchange from US $ and Euros to Sri Lankan rupees using our Forex ATM at Crescat Boulevard.

- A new Internet banking system for our customers in Bangladesh.

As always, we worked to establish new standards of excellence in the automation of business processes, spending Rs. 563.8 Mn. in 2013 to further improve our technological platforms.

Contribution of the Bank’s Subsidiaries and Associates to Prudent Growth

The Bank’s subsidiaries and associates contribute in many ways to achieve the strategic imperatives. The activities they carried out would accrue tangible benefits to the Group. Discussed below are the contribution of the selected subsidiaries and associates to achieve prudent growth of the Group.

Commex Sri Lanka SRL

The Bank incorporated a fully owned subsidiary, Commex Sri Lanka SRL, after recognising the potential in growing our remittance business in Italy, where a large Sri Lankan expatriate population resides. During 2013, we extended the company’s operations, along with the MoneyGram service, through several Italian cities, including Milan, Verona, Florence and Naples.

In 2012, Commercial Bank made arrangements with Ria Financial Services, the world’s third-largest money transfer company to act as Sri Lankan agent. Commex has since collaborated with Ria on a new service, launched in January 2014, that will enable customers to make foreign currency remittances to non-resident foreign currency (NRFC) accounts.

During the past year, we achieved substantial growth in remittances compared to 2012. Further, all arrangements have been made to submit a new application to the Bank of Italy to obtain a money transfer licence for Commex, empowering the company to launch its own transfer operation.

Equity Investments Lanka Ltd.

Equity Investments Lanka Ltd. (EQUILL) is one of Sri Lanka’s pioneering venture capital companies, with a history of success stretching back more than two decades. Commercial Bank holds 22.92% of EQUILL, which is in the business of financing entrepreneurs, mainly in the form of equity contribution.

In 2013, the Company’s performance was hampered by the challenging market conditions prevailing on the Colombo Stock Exchange. The company could not exit from some of its ventures due to drop in market indices during the year. This situation was further worsened by the decline in interest rates over the past year, which reduced the amount of interest income earned by the company.

The performance of some of EQUILL’s portfolio companies in the ‘mini-hydro’ energy sector was affected due to bad weather in key reservoir/catchment areas, which reduced the amount of hydroelectric power that these fledgling businesses could generate. As a result, EQUILL recorded a substantial drop in revenue and bottom-line profit.

Commercial Insurance Brokers (Pvt) Ltd.

Through its subsidiary, Commercial Development Company Ltd., the Bank has an indirect stake of 18.91% in Commercial Insurance Brokers (Pvt) Ltd. (CIBL), one of the premier insurance brokering firms in Sri Lanka for both life and general insurance policies. The company also boasts of a strong partnership with CA Technologies of the United States and Pronto XI ERP of Australia, making it one of the most technologically savvy firms in the industry - and ensuring that its customers are provided with speedy insurance solutions that meet global standards.

In 2013, the Company recorded a post-tax profit of Rs. 17.8 Mn., a drop of 9.35% compared to the previous year.

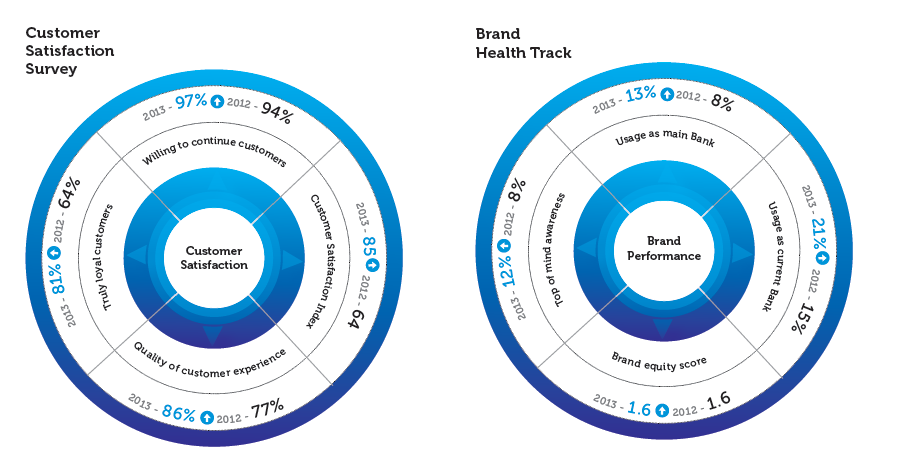

Market Surveys on Customer Satisfaction

In 2013, Commercial Bank conducted a market survey through a reputable independent research agency to obtain feedback on customer satisfaction. Applying internationally recognised analytical tools and standards, the survey was based on a research sample that included both deposits and loans customers.

The key objectives of the survey were as follows:

- Appraise the needs and expectations of Bank’s customers.

- Determine current satisfaction levels relative to customers’ service requirements.

- Determine the relative impact of specific responses on overall customer loyalty.

- Provide strategic direction for improvement in critical areas.

- Identify opportunities that can be leveraged in comparison with competing banks.

In addition to revealing loyalty scores for current customers, the survey measured trends in shifting loyalty, areas of dissatisfaction, prospects for potential growth and much more. These findings will help the Bank improve service-quality standards, process efficiencies and our overall approach to communications.

The results of the survey showed a marked increase in Commercial Bank’s customer satisfaction scores compared to the previous year, with a higher growth rate than that of our closest competitors. These positive results can be attributed mainly to increased customer loyalty metrics and a reduction in the score related to perceptions of ‘inertia’. Process-related scores, including those focused on new accounts and loan acquisitions, also increased compared to previous years.

Apart from the customer satisfaction survey, a brand health track was conducted to:

- Understand the main factors of brand equity of Commercial Bank

- Track performance of Commercial Bank against key competitor and key customer segments based on drivers such as brand awareness, brand associations, overall performance including Bank’s use by customers

- To obtain understanding of the banking and finance category

- Banking category drivers such as consideration and imagery

- Behaviours towards the banking category

- Identify different consumer profiles

Strategic Imperative 02 - Cost Efficiency via Innovation

| Strategies to Achieve this Imperative |

|

|

|

|

Initiatives taken by the Business Units to achieve Cost Efficiency via Innovation

Discussed below are the initiatives taken by the Bank during the year to achieve the above strategic imperative.

ATM Network

The Bank’s well diversified ATM network which serves as a catalyst for mobilising deposits contributes immensely in achieving a distinct edge in the highly competitive retail banking environment. As operator of the country’s largest ATM network, the Bank actively promotes this alternative channel as a more convenient way to do banking which significantly reduces the counter traffic at branches while boosting productivity.

Automating and improving our cash-dispensing capabilities remain a priority for the Bank as we work to make life more convenient for our customers. In the past year, we relaunched the cash deposit capability on selected ATMs and also improved cash dispensing across our network, allowing more denominations.

The Bank recorded the highest-ever number of transactions (325,000) and the most amount of money dispensed on a single day (Rs. 1.8 billion) on our ATM network in 2013. The Bank achieved yet another milestone by dispensing a total of Rs. 29.8 Bn. in 6.4 Mn. transactions in December 2013 which is equivalent to 206,000 transactions per day or 143 transactions per minute.

Continuing the trend in recent years, uptime performance of the Bank’s ATM network maintained over 99.9% during 2013.

| 2013 | 2012 | Growth % | |

| No. of ATMs at the end of the year |

585 | 555 | 5 |

| Value of cash dispensed during the year (Rs. Bn.) | 295.30 | 249.73 | 18 |

| Total no. of transactions during the year (Mn.) | 66.40 | 57.73 | 15 |

| Daily average value of cash dispensed during the year (Rs. Mn.) | 809 | 682 | 19 |

| Daily average no. of transactions during the year | 181,918 | 157,755 | 15 |

Leasing

Leasing related operations in all Bank branches have been brought under the lease operations module, improving operational efficiency, as well as the marketability of our

leasing products.

Treasury

The Treasury Department has completed implementation of Ambit Sierra Treasury, an end-to-end treasury management solution provided by SunGard Inc. The new software brings all Treasury products onto a single platform, with significant improvements in straight-through processing, risk management and limits monitoring, and the management of real-time positions and exposures.

The Treasury Department intends to realise cost savings by improving the productivity of both its front and back offices, offering an enhanced range of products and strengthening overall risk management. The Bank has adopted market practices introduced by SunGard, in making our treasury one of the best managed among Sri Lankan banks.

Recoveries Department

Weak credit profiles and borrower cash flows in key economic segments affected the entire Sri Lankan banking sector in 2013.

As a bank’s financial health depends on efficiency of the recovery process on loans and advances disbursements, Commercial Bank has a well-established process for recoveries, clearly defining the functions of our branches and the Central Recoveries Department.

The branch recovery process commences with disbursement of the advance. During the first three months that a borrower is in arrears, the branch and the Branch Credit Monitoring Unit conduct a comprehensive follow-up in an effort to recover the instalments in arrears and regularise the account.

The Central Recoveries Department assists branches in their quest for early recovery of Non-Performing Advances (NPA). This joint effort helps the Bank maintain the targeted NPA ratio, make timely loan loss provisions (in line with regulatory directions and our provisioning policy) and monitor all rescheduling and restructuring of advances. Monitoring includes classifying and declassifying advances according to regulatory guidelines.

In 2013, pressure on borrower cash flows prevented the timely repayment of many credit facilities. However, we were able to improve this situation by restructuring those facilities to suit borrowers’ ability to repay.

A worldwide drop in gold prices also affected the NPA ratio of the portfolio. Nevertheless, the Bank was able to mitigate the impact partly by auctioning unredeemed pawned articles in a timely manner.

For all of the above reasons, and also because of lower growth in loans and advances portfolio, the Bank’s NPA ratio deteriorated compared to 2012.

We have taken steps to reallocate resources so that we can effectively monitor advances and maintain our NPA portfolio at a low level. In addition, we have automated our loan loss provisioning process to better manage customer provisioning and write-backs, while increasing efficiency and ensuring integrity.

Information Technology

Last year, Commercial Bank leveraged technology advances across all channels, products and services, creating improvements to the banking experience that were welcomed by our customers. Other IT advances included the initiative to launch a new Data Centre that reflects global standards; by reducing the number of physical servers from 70 to 4 through server virtualisation, we have saved approximately 9,000 cubic feet of space.

Other Support Departments

In addition to the support services units discussed above, all other units in the Bank - including Legal, Administration, Logistics, Procurement, Inspection, Operations, Finance and Planning, and Human Resources - made enormous contributions to achieve the cost efficiency of the Bank over the past year.

Contribution of the Bank’s Subsidiaries to Cost Efficiency

The activities of the subsidiaries would directly accrue benefits to the Bank, especially in terms of cost efficiency. Detailed below are the activities carried out by identified subsidiaries which would have a direct impact on cost efficiency of the Bank.

Commercial Development Company PLC

Commercial Development Company (CDC) was formed in 1980 to construct the head office building of the Bank and continues to rent it to the Bank while providing various other value-added services. The Bank holds 94.55% of the Company’s share capital.

CDC recorded a post-tax profit of Rs. 151.4 Mn. in 2013, a 35.40% decrease over the previous year. The company’s profit decrease was mainly due to a substantial decrease in fair value gain on investment property recorded in 2013, compared to 2012. However, the operating profit recorded a growth of 35.40% mainly due to an increase in building rent, in line with market rates. Expansion of CDC’s staff-outsourcing business also contributed to its higher revenue. Despite a significant drop in its vehicle-hire business, CDC posted an improvement in operating profit with reduced operating costs.

ONEzero Company Ltd.

ONEzero Company, a 100%-owned subsidiary of the Bank, provides information technology services and solutions - primarily to the Bank, but also to a few selected outside customers. ONEzero’s scope of services includes IT support, hardware, software development and post-warranty maintenance.

In 2013, the Company recorded a post-tax profit of Rs. 17.1 Mn. a drop of 17.40% compared to 2012.

Strategic Imperative 03 - Exemplary Governance

|

|

|

Governance

At Commercial Bank, we operate our business according to the highest ethical standards, based on widely recognised principles and best practices, and conforming to all applicable laws and regulations. In drafting policies and executing plans, we follow strict principles of corporate governance that define the structure and responsibilities of our Board of Directors, ensure legal and regulatory compliance, protect stakeholder interests, manage business risks and govern the quality of information we disseminate.

Governance Structure of the Bank

As illustrated, the Board of Directors, as the highest governance body of the Bank, ensures the alignment of business strategy with sustainable business performance by providing direction for our effective engagement with all stakeholders.

The Directors serving on the Board as of December 31, 2012 continued in their roles through 2013. The Chairman of the Board is an Independent Non-Executive Director, while the Managing Director/Chief Executive Officer is a Non-Independent Executive Director. Board members are eminent professionals drawn from a range of industrial and financial disciplines. They use their experience and expertise to guide Commercial Bank as it pursues excellence in terms of triple bottom-line performance.

The Board evaluates the strategies set out in the Bank’s Corporate Plan and Budget, and gauges the relevance of its vision and mission, as well as the various policies and goals set out by each division of the Bank. The Board Nomination Committee assesses the qualifications, experience and abilities of Directors, along with key management executives. In doing so, the Committee takes into account the Bank’s strategic, economic, social and environmental objectives, applying them in judging the accountability of Key Management Personnel.

The Bank has formed 4 mandatory and 3 voluntary Board Sub-Committees to fulfil regulatory and other requirements and to provide direction for better governance of the Bank’s activities. These Sub-Committees meet regularly to discuss matters falling within their respective charters, and their recommendations are duly communicated to the main Board. The composition of the Board and its Sub-Committees is given under Corporate Governance section.

Avoiding Conflicts of Interest

The governance structure of the Bank ensures that Directors take all necessary steps to avoid conflicts of interest or the appearance thereof. If a Director is found to have a conflict of interest, the matter is discussed at Board meetings that includes Independent Non-Executive Directors who have no material interest in the transaction. Directors abstain from voting on any Board resolution in which they or their close relations have interests. Their votes are also not counted in establishing the quorum for the relevant agenda item.

In pursuance of the requirements under Sections 192 and 193 of the Companies Act No. 07 of 2007, Directors have duly disclosed any financial accommodation from and/or deposits made with the Bank by entities where they function as Chairman or a Director - as disclosed in the section on ‘Directors’ Interest in Contracts with the Company’. Further disclosures have been made in Note 53 to the Financial Statements as required by the Sri Lanka Accounting Standard LKAS 24 on ‘Related Party Disclosures’.

As required by the Listing Rules of the Colombo Stock Exchange, all Directors have submitted annual declarations to the Company Secretary on their shareholdings in other companies.

Role of the Board in Risk Management

The specific tasks undertaken by the Board in managing risk are discussed in the section on ‘Managing Risk at Commercial Bank’.

It is customary for the Board to carry out an in-depth SWOT (strengths, weaknesses, opportunities and threats) analysis, including sustainability-related issues, as part of its deliberations leading to the preparation of the Corporate Plan, which sets out the Bank’s strategic direction. During this process, heads of the Bank’s main business and support service divisions make presentations on how they intend to reach performance targets, taking into account challenges related to economic, social and environmental aspects. These presentations provide inputs for the Board’s strategy development.

The following methodologies are used by the Board in ensuring that the targets setout in the Corporate Plan are met:

- Review of the Bank’s performance at monthly Board meetings, assessing its progress towards economic, social and environmental goals.

- Recommendations through Board-appointed Sub-Committees on governance, including compliance with internal controls, human resources and remuneration, risk management, credit appraisal, the role of information technology and strategic investments.

- Review of statutory and other forms of compliance through a quarterly paper on the operations of the Bank, including those in Bangladesh. The content of this paper is validated by the Internal Audit Department, which carries out checks on a random basis covering all areas.

- Obtaining input from the SEMS co-ordinator, who focuses on social and environmental issues backed by a Board-appointed team that is charged with identifying and managing the Bank’s economic, social and environmental performance - including relevant risks and opportunities, as well as compliance with regulatory requirements.

- Representation of the Board on the CSR Trust Fund, linking the Bank’s strategy to the activities carried out via the fund and vice versa. The activities of the CSR Trust Fund are discussed below on Strategic Imparative 06 - Being Responsible to the Community section.

- The stakeholder engagement process, which helps the Board to identify sustainability issues faced by shareholders and employees, and to take remedial action.

Remuneration and Incentives

The Board of Directors receives monthly remuneration as recommended by the Board Human Resources and Remuneration Committee. Remuneration is approved by the full Board based on criteria linked to the achievement of strategic objectives and targets. Directors are not entitled to bonuses, shares, incentive payments, termination benefits or any kind of retirement benefits.

Commercial Bank has a well-established target-driven culture focused on achieving the goals set out in our Corporate Plan. Executive Directors of the Board, as well as other executive officers and Key Management Personnel are remunerated based on how well they achieve mutually agreed targets. All criteria for determining performance-based compensation, along with succession arrangements, are detailed in the ‘Board Human Resources and Remuneration Committee Report’. We do not employ any outside consultants in determining remuneration. The two employee associations - the Executive Association and the Ceylon Bank Employees’ Union (CBEU) - maintain a regular dialogue with the Board and Bank management on the subject of remuneration, and their views are given due consideration in the formulation of remuneration policies and proposals.

The Bank’s Credit Policy encompasses a Social and Environmental Policy with a view to sustaining our position while aiming to be the best player locally and regionally. The executive officers responsible for implementation and monitoring of the SEMS of the Bank are remunerated based on the level of achievement of targets linked to SEMS. Similarly, those executive officers attached to Departments who deal with employee remuneration, welfare, staff training and development and other employee - related services too are remunerated based on achievement of targets set for them in terms of labour practices and decent work and human rights.

The remuneration package of the Non-Executive Officers of the Bank are covered by the Collective Agreement signed with the CBEU.

The business success of the Bank demands independent decision-making, ethical behaviour, transparency, effective risk management and long term planning. These qualities ensure an ethical, legal and compliant organisation at every level and help prevent illegal or unethical business activities. Commercial Bank has taken steps to ensure that all critical processes and procedures are well-documented to promote smooth functioning and avoid potential misinterpretations.

To achieve the objectives outlined above, in 2006 Commercial Bank prepared a Business Continuity Plan (BCP) that was sanctioned by the Board of Directors. The Bank also has a Business Continuity Management Steering Committee (BCMSC) comprising members from the corporate and senior management teams who drive all business continuity efforts. The BCMSC provides overall guidance to the BCP committee, which consists of ‘business champions’ whose mandate is to develop and update continuity planning for all aspects of the Bank’s operations. We also have a disaster recovery plan to supplement the BCP and ensure the continuity and functionality of information systems. The BCP includes policies on staff succession, crisis communications, staff travel, supply chain management, and awareness and training.

In addition, the Integrated Risk Management Department analyses and reports on all types of risks associated with the Bank’s operations.

The Bank’s management team has also established several committees that are responsible for carrying out market surveys, developing products and analysing customer expectations, all aimed at ensuring the sustainability of its business. Several specialised departments continuously update all levels of staff with developments in the financial markets. Others conduct peer reviews, conveying the results to the Board and management.

Commitment to External Charters

Commercial Bank has committed to a number of external charters, codes and standards that reflect our operating values, principles and commitments to stakeholders.

| External Charter | Year of Adoption | Countries/ Operations Where Applied |

Range of Stakeholders Involved in the Development and Governance of These Initiatives | Compliance Requirement | |

| Mandatory | Voluntary | ||||

| United Nations Global Compact principles | 2003 | Sri Lanka | Multi stakeholders | ||

| International Finance Corporation guidelines and performance standards that shape the Bank’s Social and Environmental Management System | 2010 | Sri Lanka | Multi stakeholders | ||

Memberships in Associations

The Bank has general memberships in a number of sectoral, industrial and professional organisations and associations which are listed below. The Bank’s Managing Director is an active member of the National Chamber of Commerce. Although, the Bank does not hold positions on the governance bodies of other institutions, we extend our fullest support for their activities attending various events organised.

- Sri Lanka Banks' Association (Guarantee) Ltd.

- The Clearing Association of Bankers

- Institute of Bankers of Sri Lanka (IBSL)

- The Ceylon Chamber of Commerce, Sri Lanka

- Lanka Swift User Group (LSUG)

- The National Chamber of Commerce, Sri Lanka

- International Chamber of Commerce, Sri Lanka

- European Chamber of Commerce, Sri Lanka

- Society for International Development (SID)

- Association of Banking Sector Risk Professionals

- The Council for Business with Britain

- Association of Compliance Officers of Banks, Sri Lanka

Ethics and Integrity

Commercial Bank’s Code of Ethics spells out the expected standards of behaviour and sets the operating principles to be followed. Our Code of Ethics requires that it is necessary to ensure that the standards of behaviour expected of Management and employees are followed to the letter and spirit. Every officer is required to ensure that the Bank at all times maintains high ethical standards and adequate internal control measures are in place guarding against unethical practices and irregularities. In this connection, the Bank’s Code of Ethics clearly stipulates the expected standard of behaviour and the “Do’s” and “Don’ts” the employees must observe. Further, the Code provides guidance on identification, follow up action and reporting of malpractices, if any.

We operate according to well-defined values, principles and rules governing the conduct of our Board of Directors, Key Management Personnel, Executives and other staff. Our core values guide us in assessing the economic, social and environmental impacts of our actions, and in mitigating any impacts. The Bank’s ethical commitment is articulated through a variety of means including the following:

- An Oath of Secrecy signed by every staff member, accepting accountability for their actions.

- The Bank’s Code of Ethics and Whistle-Blowers Charter, which encourage staff members to report any suspected wrong-doings. The Whistle-Blowers Charter is based on guidelines issued by the International Chamber of Commerce.

- Making every staff member aware of the Bank’s Code of Conduct during induction programmes, binding them to meet its requirements from recruitment until their employment ends.

- The Bank’s grievance-handling process, which ensures that all issues referred to the Human Resource Department are adequately addressed with strict confidentiality.

Operations Assessed for Risk-Related Corruption

The Integrated Risk Management Department (IRMD), along with other units of the Bank, carries out operational risk assessment for all types of corruption and internal fraud. These assessments, covering the full spectrum of banking operations, are carried out on a half-yearly basis by the risk ‘owners’ in each area. The IRMD regularly reviews and updates these risk assessments. Controls relating to risk are tested by the Inspection Department. The officers of the Inspection Department examine the activities of the Bangladesh operation too as part of their periodic inspection programmes.

All incidents of corruption and internal fraud identified through key operational risk indicators and from operational losses are analysed by the IRMD on a monthly basis. The officers of IRMD evaluate existing controls and the actions taken to avoid repetition of such incidents. Any new mitigating measures developed in this process are applied to all operating units of the Bank. This process also covers our operation in Bangladesh through a continuous dialogue with the Risk Management Division in Bangladesh.

Training on Anti-Corruption Policies and Procedures

Over the past year, the Bank’s Anti-Money Laundering (AML) Department continued to educate staff at all levels on the requirements of the Prevention of Money Laundering Act. These training programmes also covered ‘Know Your Customer’ requirements and any unlawful activities, which includes corruption, bribery and insider dealing. During the year 2013, the AML Department conducted 25 such programmes, which were attended by 887 participants covering 1,712 person hours. In addition, the Bank’s Bangladesh operations conducted one programme dedicated on corruption. Further, staff at all level is made aware of the requirements, procedures for detecting and informing any suspicious transactions via circular instructions.

We intend to communicate our anti-corruption policies and procedures to our suppliers and other business partners, which at present are not included in the business contracts.

Actions Taken in Response to Incidents of Corruption

Incidents of corruption are brought to the notice of the Bank’s Executive Integrated Risk Management Committee in monthly meetings by the officers of the AML Department. In 2013, no incidents of corruption were detected.

It is the Bank’s practice to table the details of fraud - if the financial losses involved exceed a predetermined threshold - at quarterly meetings of the Board Integrated Risk Management Committee. In such events, we identify any lapses in our internal control systems that led to the incident, then take steps to avoid a recurrence and discipline any staff who were involved. Further, follow-up action is taken via internal circulars to employees, educating them about the effectiveness of existing internal control mechanisms.

Last year, neither the Bank nor its employees faced any corruption-related charges.

However, the Bank’s AML Department detected ten accounts involving suspicious transactions during the year 2013 and those accounts promptly reported to the Financial Intelligence Unit

of the Central Bank of

Sri Lanka. It is pertinent to mention that the Bank took steps to close one of above accounts opened to operate a pyramid scheme.

Fines and Non-Monetary Sanctions

The Bank received no fines or sanctions in the past year for breach of laws and regulations.

Product and Services Labelling

The following is required for the labelling of all products and services of the Bank:

- The source of components for the product or service.

- Contents, particularly substances that may have an environmental or social impact.

- Instructions on the safe use of the product or service.

No incidents were reported in which the Bank was fined or warned because of non-compliance with regulations or voluntary codes on product and service information and labelling.

Sale of Banned or Disputed Products

Commercial Bank does not sell or market products or services that are banned in any market or subject to stakeholder questions or public debate. During 2013, the Central Bank of

Sri Lanka issued a Direction to banks prohibiting the issue of certificates of deposit to customers, and Commercial Bank duly complied with the requirement. No incidents were reported where the Bank was fined or warned due to non-compliance with regulations and voluntary codes concerning marketing communications.

Breach of Customer Privacy and Loss of Customer Data

In 2013, the Bank received two complaints claiming that account information had been compromised to a third party. The complaints were duly investigated, and it was determined that in neither case had account information been divulged to any unauthorised persons.

Apart from the above incidents, the Bank neither received any complaints regarding breach of customer privacy nor identified any leaks, thefts or loss of customer data during audits carried out by the Internal Audit Department.

Fines for Non-Compliance with Laws and Regulations

During the past year, no incidents were reported in which Commercial Bank was fined or warned as the result of non-compliance with laws or regulations concerning the provision and use of bank products and services.

Strategic Imperative 04 - Managing Capital

| Strategies to Achieve this Imperative |

|

|

|

|

|

|

Given the low gearing ratio of our Balance Sheet and risk-weighted assets, Commercial Bank is comfortably capitalised. This is further evidenced by our Tier I and total capital adequacy ratios of 13.27% and 16.91%, respectively, as at the end of 2013. The Bank’s end-of-year capital adequacy ratio, along with the comparable figures for 2012, are presented under Managing Risk at Commercial Bank.

Commercial Bank’s strong capitalisation gives us sufficient financial muscle to expand our business operations in future. Apart from compliance with the minimum capital requirements specified by the regulator, the objectives of our capital management efforts include:

- Maintaining internal capital targets, which are more stringent than regulatory requirements.

- Optimising capital usage for maximum profitability, meeting the expectations of shareholders.

- Supporting future business expansion.

- Supporting current and future credit ratings.

- Ensuring smooth transition to potentially higher capital requirements under the advanced approaches of Basel II and requirements under Basel III, once implemented.

The success of the Bank’s capital management efforts in recent years is evident from the following data:

| Indicator | 2013 | 2012 | 2011 | 2010 | 2009 |

| Growth in total assets (Rs. Mn.) | 94,864.4 | 70,413.1 | 71,039.1 | 47,745.0 | 41,101.0 |

| Growth in risk-weighted assets (RWA): | |||||

| - Total | 31,267.4 | 41,674.7 | 44,318.2 | 53,707.2 | (4,632.9) |

| - RWA for credit risk (Rs. Mn.) | 22,678.2 | 38,994.1 | 40,616.0 | 47,680.9 | (10,693.2) |

| - RWA for market risk (Rs. Mn.) | 2,230.1 | (552.6) | 218.4 | 1,778.5 | 779.4 |

| - RWA for operational risk (Rs. Mn.) | 6,359.1 | 3,233.2 | 3,483.8 | 4,247.8 | 5,280.8 |

| Capital adequacy ratios: | |||||

| - Tier I (%) | 13.27 | 12.64 | 12.11 | 10.87 | 11.90 |

| - Total (%) | 16.91 | 13.85 | 13.01 | 12.27 | 13.91 |

| ROA (%) | 1.87 | 2.12 | 1.94 | 1.60 | 1.43 |

| ROE (%) | 18.40 | 20.96 | 20.28 | 17.87 | 15.83 |

Specific initiatives undertaken in the past year included a borrowing of US $ 75 Mn. from the International Finance Corporation on a 10-year subordinated debt agreement.

In light of our low levels of non-performing advances and the significant provisioning already made, the capital of Commercial Bank is relatively unencumbered. This stability is also evident from our higher credit rating and excellent relationships with shareholders, whose support we can rely on if additional capital is required for business expansion.

Strategic Imperative 05 - Managing Risk

| Strategies to Achieve this Imperative |

|

|

|

|

|

|

- The Bank embarked on a journey in implementing a Basel - II compliance software solution to facilitate migrating to advanced approaches

in capital computation in 2013. The risk related data derived through

this system would enhance the risk based decision making. - ICAAP framework implemented during 2012/13 has enabled the Bank to gauge capital adequacy in relation to its present/potential risk profile. This integrates the Bank’s strategic plan with risk management and capital planning in an objective manner.

- The Stress Testing framework implemented during the year under review helps the Bank in assessing the resilience on hypothetical but plausible potential events and to take proactive decisions to mitigate

such risks.

Overall business strategy of the Bank is well-supported by its risk strategy which focuses on optimising the risk-return trade off. The responsibility of driving the Bank’s risk strategy and governance framework lies with the Board and the Senior Management. The Bank’s Risk Governance Framework is the foundation for its risk strategy which in turn supports the effective management of capital adequacy in relation to the overall risk profile of its business model. The Risk Management Framework is a set of independent components based on which risk management at the Bank is designed, implemented, monitored, reviewed and continuously improved. A comprehensive set of risk related policies, procedures and processes have been established in the Bank to formulate a formal risk management function within the organisation. Risk related committees with well-defined responsibilities support an effective risk management mechanism covering key business areas of the Bank. The integrity, effectiveness and transparency of risk based decision making is well-supported by this Risk Governance framework.

Detailed risk management report on how we manage our risks as a responsible financial intermediary is given on Managing Risk at Commercial Bank.

Strategic Imperative 06 - Being Responsible to the Community

| Strategies to Achieve this Imperative |

|

|

Commercial Bank Social Responsibility Trust Fund

Recognising our Bank’s responsibilities in the communities where we do business, we have undertaken a variety of social initiatives, the most important of which is the Commercial Bank Social Responsibility Trust Fund (CSR Trust), founded in 2004 with a seed capital of Rs. 25 Mn. To back up our commitment, the Bank contributes up to 1% of annual post-tax profits to the Fund. With last year’s contribution of Rs. 50 Mn., total funding to date exceeds Rs. 340 Mn. rupees.

The deed of the CSR Trust outlines the following objectives:

- To support education in Sri Lanka.

- To assist in improving health services in Sri Lanka.

- To preserve and improve the environment.

- To support and provide community services.

- To preserve and promote the cultural heritage of Sri Lanka, and to promote culture and arts generally.

- To undertake other charitable activities decided by the Trust.

Goals and Performance

As part of our corporate responsibility strategy, Commercial Bank has adopted ‘education’ as the principal theme of our local community engagement activities. We support school children and young adults across Sri Lanka, regardless of gender, race, religion or social background. Our main focus is on IT education and English language proficiency - areas selected after careful consideration of the Bank’s broad vision and the development priorities of the Government.

Organisational Responsibility

The Board of Trustees of the CSR Trust includes five representatives of Commercial Bank. The Chairman of the Trust has overall responsibility for the Bank’s commitment to community. A dedicated senior officer of the Bank serves as the CSR co-ordinator, reporting directly to the trustees and assisting them in achieving the objectives of the Trust.

The Trustees of the CSR Trust are:

- Mr. L. Hulugalle -

Trust Chairman

Director, Commercial Bank - Prof. U.P. Liyanage

Director, Commercial Bank - Mr. W.M.R.S. Dias -

Managing Director/CEO, Commercial Bank - Mr. K.D.N. Buddhipala -

CFO, Commercial Bank - Mr. L.H. Munasinghe -

Deputy General Manager - Marketing, Commercial Bank - Mrs. Priyanthi Perera -

CSR Co-ordinator, Commercial Bank

Training and Awareness

In addition to training arranged for CSR unit officers, the Trust Chairman sends written advice to all Commercial Bank Branch Managers regarding the activities of the Trust, with guidelines for implementation thus creating awareness amongst staff members.

Main focus areas ofthe CSR Trust

- Education

- Healthcare

- Culture andheritage

- Rehabilitation of war heroes

- Regional social initiatives

- Disaster relief, and preservation of the environment

Monitoring and Follow-up

The CSR Co-ordinator is responsible for keeping the Board of Trustees informed on all corporate responsibility activities. The trustees meet once a month to approve strategic project proposals and ensure that proper follow-up action is taken for all current projects.

Overview of Corporate Responsibility Activities in 2013

The Trust’s corporate responsibility initiatives are focused on six key areas: education, healthcare, culture and heritage, rehabilitation of war heroes, regional social initiatives and disaster relief, and preservation of the environment. While the advancement of children’s education has been the Trust’s main focus area, many other notable projects were undertaken during the past year. These were selected for their significance to the community and for their ability to deliver sustainable long-term benefits to direct recipients and to the country at large.

Method of Identification and Selection of Projects

The Chairman of the CSR Trust sent letters to all Commercial Bank Branch Managers in 2013, asking them to help identify projects supporting their local communities. Bank branch staff voluntarily submitted the highest number of proposals ever received by the Trust, with a particular emphasis on education and regional corporate responsibility projects. A number of organisations also submitted proposals, which the CSR Co-ordinator and her team evaluated according to the Trust’s guidelines. After the Board of Trustees evaluated and ratified shortlisted proposals, approved projects were implemented by volunteer staff at branches and in support service divisions such as IT, procurement, logistics, premises and marketing.

Brief Accounts of the Projects

Education