Our second Integrated Annual Report

Commercial Bank was the pioneer in Sri Lanka in adopting triple-bottom-line reporting more than a decade ago. Ever since, we firmly believed that any discussion on sustainability couldn’t be separated from a broader discussion on the Bank’s overall performance. As such, in the past, instead of a separate sustainability report as was then advocated, we included a supplement within the Annual Report detailing sustainability-related information not captured elsewhere. In 2012, we took this approach forward to better reflect our holistic thinking. Accordingly, we produced our first integrated Annual Report. Building on that approach, this annual report explains the Bank’s value creation process around the Bank’s strategic imperatives.

Structure of the Report

This Report has been structured to communicate more coherently the relationships and interdependence of the various aspects of our business. These aspects include the likes of core competencies, strategic imperatives, management’s decisions and actions, governance, risk, compliance, performance and prospects in the context of creating value over time. It will assist the reader, primarily investors, to assess the Bank’s current year’s performance and the future potential. It is the story of our value creation.

The Financial Review, Letter from the Chairman, Managing Director’s Review, Financial & Operating Highlights and detailed Financial Statements will assist the reader to assess the current year's performance in comparison to the previous year(s).

The Management Discussion and Analysis in general and the Business Model and Strategic Imperatives for Value Creation in particular, will help the reader in evaluating the Bank’s future potential. To facilitate this, these sections carry a detailed analysis of the various stakeholders and a discussion on the initiatives of the Bank for the benefit of those stakeholders (and the impact thereof) along with initiatives planned for the near future.

Value Creation and Capital Formation

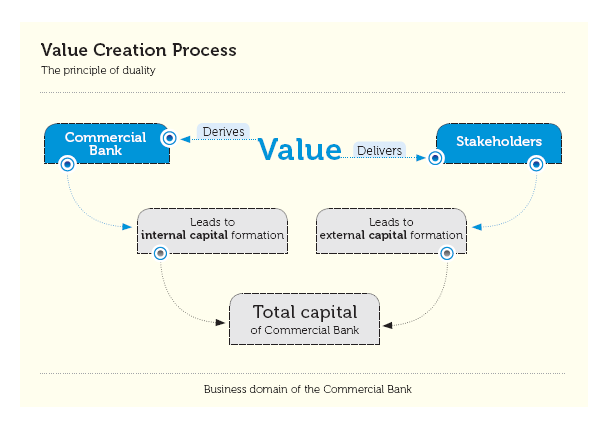

There is duality to the process of value creation, viz. delivering value to and deriving value from stakeholders. Both aspects are relevant as the ability of the Bank to create value for itself is inextricably linked to the value it creates for its stakeholders. Delivering value essentially involves creating financial and non-financial value for the benefit of the stakeholders, which leads to external capital formation in the form of investor capital, customer capital, regulatory capital, business partner capital and social & environmental capital. Deriving value in turn involves creating value for the Bank itself, which leads to internal capital formation in the form of financial capital and institutional capital. We call these ‘capitals’ as they will help us in creating value going forward.

This duality to the process of value creation is depicted in the diagram below.

Concepts, Principles and Guidance

In preparing this report, we have drawn on concepts, principles and guidance from the Global Reporting Initiative (GRI) Sustainability Reporting Guidelines G4 (2013) [www.globalreporting.org], the International Integrated Reporting Framework (2013)[www.theiirc.org] and the Smart Integrated Reporting Methodology™ [www.smart.lk], where applicable.