| Results for the year |

|

|

|

|

|

|

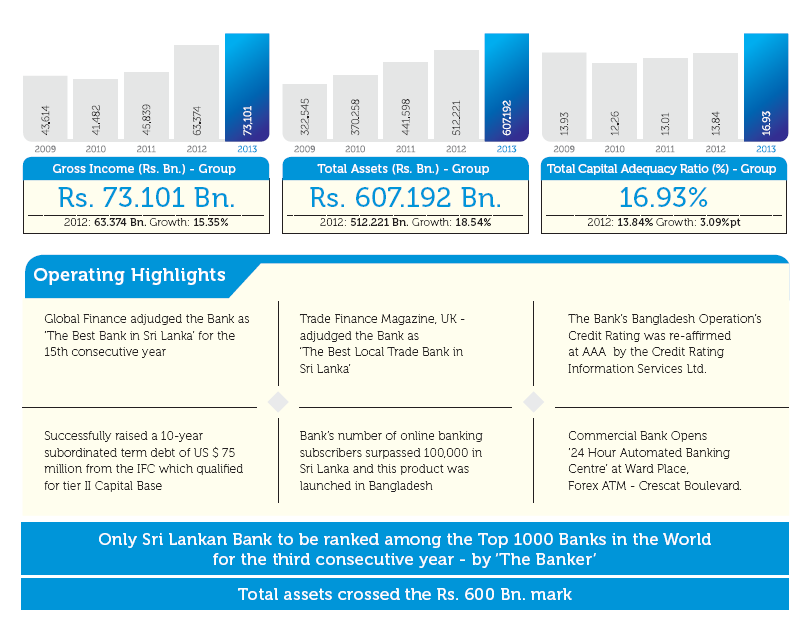

| Income |

73,101.378 |

63,373.753 |

15.35 |

73,159.580 |

63,395.047 |

15.40 |

| Profit before Financial VAT and Taxation |

16,654.587 |

16,287.867 |

2.25 |

16,479.473 |

16,282.646 |

1.21 |

| Profit Before Taxation (PBT) |

14,692.751 |

14,312.914 |

2.65 |

14,510.519 |

14,295.333 |

1.51 |

| Provision for Taxation |

4,119.294 |

4,231.747 |

(2.66) |

4,065.008 |

4,197.004 |

(3.15) |

| Profit After Taxation (PAT) |

10,573.457 |

10,081.167 |

4.88 |

10,445.511 |

10,098.329 |

3.44 |

| Revenue to the Governments |

5,959.636 |

6,078.192 |

(1.95) |

5,905.636 |

6,043.192 |

(2.82) |

| Gross Dividends |

5,519.235 |

5,421.421 |

1.80 |

5,519.235 |

5,421.421 |

1.80 |

| |

|

|

|

|

|

|

| At the year end |

|

|

|

|

|

|

| Shareholders’ Funds (Capital and Reserves) |

61,446.228 |

52,968.420 |

16.01 |

60,943.999 |

52,577.000 |

15.91 |

| Deposits |

451,098.946 |

390,568.682 |

15.50 |

451,152.923 |

390,611.548 |

15.50 |

| Gross Loans and Advances |

379,237.437 |

343,739.337 |

10.33 |

379,252.897 |

343,797.081 |

10.31 |

| Total Assets |

607,192.266 |

512,220.640 |

18.54 |

606,607.105 |

511,742.708 |

18.54 |

| |

|

|

|

|

|

|

| Information per Ordinary Share (Rs.) |

|

|

|

|

|

|

| Earnings (Basic) |

12.45 |

12.11 |

2.81 |

12.31 |

12.13 |

1.48 |

| Earnings (Diluted) |

12.43 |

12.09 |

2.81 |

12.29 |

12.11 |

1.49 |

| Dividends - Cash |

– |

– |

– |

4.50 |

4.50 |

– |

| Dividends - Shares |

– |

– |

– |

2.00 |

2.00 |

– |

| Net Assets Value |

72.37 |

63.55 |

13.88 |

71.78 |

63.08 |

13.79 |

| Market value at the year end - Voting |

N/A |

N/A |

– |

120.40 |

103.00 |

16.89 |

| Market value at the year end - Non-voting |

N/A |

N/A |

– |

93.00 |

91.10 |

2.09 |

| |

|

|

|

|

|

|

| Ratios |

|

|

|

|

|

|

| Return on Average Shareholders’ Funds (%) |

18.48 |

20.76 |

(2.28%pt) |

18.40 |

20.96 |

(2.56%pt) |

| Return on Average Assets (%) |

1.89 |

2.11 |

(0.22%pt) |

1.87 |

2.12 |

(0.25%pt) |

| Price Earnings (times) - Ordinary Voting Shares |

N/A |

N/A |

|

9.79 |

8.50 |

15.18 |

| Price Earnings (times) - Ordinary Non-voting Shares |

N/A |

N/A |

|

7.56 |

7.52 |

0.53 |

| Year-on-year growth in Earnings (%) |

4.88 |

27.09 |

(22.21%pt) |

3.44 |

28.10 |

(24.66%pt) |

| Dividend Yield (%) - Ordinary Voting Shares |

N/A |

N/A |

|

5.40 |

6.31 |

(0.91%pt) |

| Dividend Yield (%) - Ordinary Non-voting Shares |

N/A |

N/A |

|

6.99 |

7.14 |

(0.15%pt) |

| Dividend Cover on Ordinary Shares (times) |

N/A |

N/A |

|

1.89 |

1.86 |

1.61 |

| |

|

|

|

|

|

|

| Statutory Ratios: |

|

|

|

|

|

|

| Liquid Assets (%) |

N/A |

N/A |

– |

34.05 |

25.79 |

8.26%pt |

| Capital Adequacy Ratios: |

|

|

|

|

|

|

| Tier I (%) - Minimum requirement 5% |

13.30 |

12.63 |

0.67%pt |

13.27 |

12.64 |

0.63%pt |

| Tier I & II (%) - Minimum requirement 10% |

16.93 |

13.84 |

3.09%pt |

16.91 |

13.85 |

3.06%pt |